Many freight brokers, and motor carriers that have brokerage operations, find that as they scale their business, they must scale their workforce at the same time.

How Automating Load Brokering Helps Carriers Meet Trucking Challenges

Newtrul CEO Ed Stockman discusses top issues facing freight brokers and motor carriers and how technology in the load-matching process can help.

Ed Stockman, Newtrul CEO, talks about how technology can help with load matching.

Photo: Canva/Newtrul

Larger companies such as C.H. Robinson and legacy brokers have addressed this challenge by digitizing their operations to make the process more efficient and limit the staffing increases needed as the business grows. But digitizing transactions still eludes many mid-size brokers, according to Ed Stockman, CEO at Newtrul.

“There are 10,000 to 15,000 freight brokers in the mid-market category that lack the sophistication or capabilities to build their own technology,” he says. “Those that struggle the most plateau at $50 million to $70 million in annual revenue. Only 1% of freight brokers can ever scale north of $100 million in annual revenue.”

Stalled growth is the byproduct of inefficient resource allocation, he explains.

“It takes a freight brokerage roughly four to five times more people to find a truck than it does [to find] a new customer,” he says. “A freight broker spending a ton of money finding trucks and trying to service customers versus working to attract more customers encounters a big bottleneck when trying to grow their business.”

He emphasizes mid-size brokers need to reign in their top operating costs — procuring a truck and communicating with operators — to scale their businesses.

“Communication is a key issue. Does that operator prefer What’s App? Do they prefer ChatGPT? Do they prefer phone calls or texts?” he asks. “There are a lot of different ways to communicate and a lot of different personas of trucking companies, truck drivers, dispatchers, and loan planners. These challenges make marketing and standardizing your processes and procedures more difficult.”

Newtrul helps mid-size freight brokers standardize and digitize communication and procurement to “find the right truck for shipments and offer that load directly through a central application,” Stockman says.

“We pursued mid-size freight brokers when we formed Newtrul,” he says. “The concept was for us to remain Switzerland. We can’t align ourselves with one broker. We can’t be a broker ourselves. We have to sit in the middle. And that’s where the name Newtrul really came from. We sit in the middle of shippers, brokers and carriers, and digitize the transaction for all three to lower their costs so they can invest in and grow their businesses.”

API Integrations

Stockman co-founded Newtrul in 2019, though its services were not made widely available until 2020.

He explains it took some time to build integrations with the legacy transportation management systems used by many brokers.

“We needed to build an API to digitize transactions,” he says. “That was a long, difficult learning curve. We not only had to build APIs, but then we had to educate brokers to show them why this mattered.”

The pandemic rolled in right around the time Newtrul had completed API development.

“Suddenly, the trucking companies we were pursuing, didn’t need us anymore,” he says. “They were getting three or four times the typical rates on a lane and didn’t need a marketplace that brought clients together. They could just raise their hand and say, ‘I got a truck and I want $10,000 for the load,’ and they would get it.”

However, interest in Newtrul soared as the market normalized.

“We’ve seen an exponential growth in our supply base and number of transactions,” he says. “Things are finally starting to come together.”

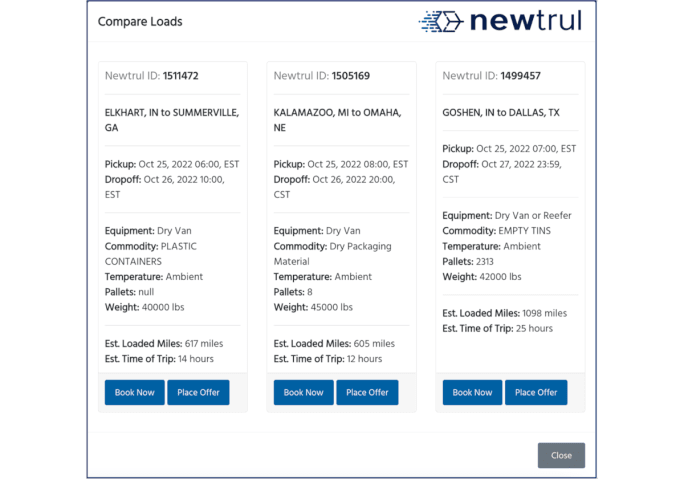

Comparing loads lets brokers analyze which are better.

Photo: Newtrul

New Ways to Interface

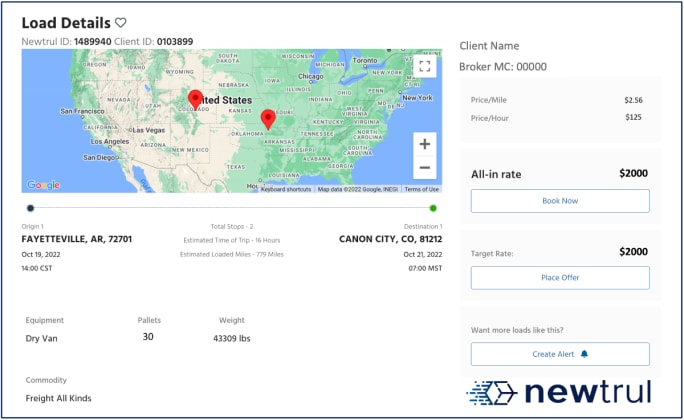

Newtrul offers two ways for carriers to interact or interface with freight brokers, according to Stockton.

- Carriers can log into Newtrul.com. Here, they can search, find, and digitally book shipments from over 100 brokers in one place. “We are aggregating and consolidating their efforts to find the best load for their truck,” he says.

- Carriers can invest in integrations. “A lot of carriers are investing in integrations,” he says. “This is surprising because carriers are a little behind the curve with adopting tech. But in the mid-market, new digital-focused fleets are entering the space. These folks are all about integrations. They want to consolidate shipments in their native application. With our integrations, we can push loads into their system so they can transact without coming into Newtrul.”

The company is now working to integrate the platform with shippers.

“We have a lot of brokers that request integrations with shippers,” Stockman says. “This goes back to where they’re spending their time and resources. Finding the right truck and the right shipments can be a labor-intensive, tedious process.”

Currently, the shipper-broker transaction largely resides on big online boards, where an auction-type process takes place.

“On these platforms, a shipper will say, ‘Here’s a load, bid on it,’ then selects the lowest bidder by 7 p.m.,” he says. “Now you have a ton of brokers that are clicking refresh throughout the day, trying to figure out if they won that shipment, because their commission and quota numbers depend on it.”

The result is an aggressive, cutthroat culture, according to Stockman.

Newtrul wants to give brokers a more seamless option where operators set rules for what they need to receive on a lane, whether it’s 5%, 10%, or even 15%.

“We want to digitize that process. But before we do, we want to understand your business rules, level of risk tolerance, and try to automate some of those processes. This way freight brokers can focus on building relationships and developing rapport with clients instead of clicking refresh to see the status of their bid,” he adds.

3 Trends in Logistics and Technology

The COVID-19 pandemic ushered in a winding road of disruptions for freight brokers and carriers. Though the dust is settling on the chaos, Stockman predicts there are other trends that can wreak havoc on operations if freight brokers and carriers are not paying attention:

1. Compliance will get Harder to Enforce

Future regulations for hours of service for trucking companies and bonds for brokers and trucking companies are certain. Equally certain is that there will be some who will not comply.

“We’re seeing a huge increase in the industry in bad actors, i.e., double brokers,” he says. “Those folks have no intention of operating safely and with integrity. They … take a shipment from Chicago to Los Angeles for $3,000 to $4,000 but have zero intention of paying the trucking company who executed the shipment,” he says. “They are going to pocket that revenue. They’ll do that 10 times in a week and earn $40,000, then shut their doors and never do it again.”

Stockman says he has never seen more of this in my career as he does right now.

“We’re seeing thousands of new freight brokers register every year. A fairly significant number of those registrants have no intent of operating with any type of integrity.”

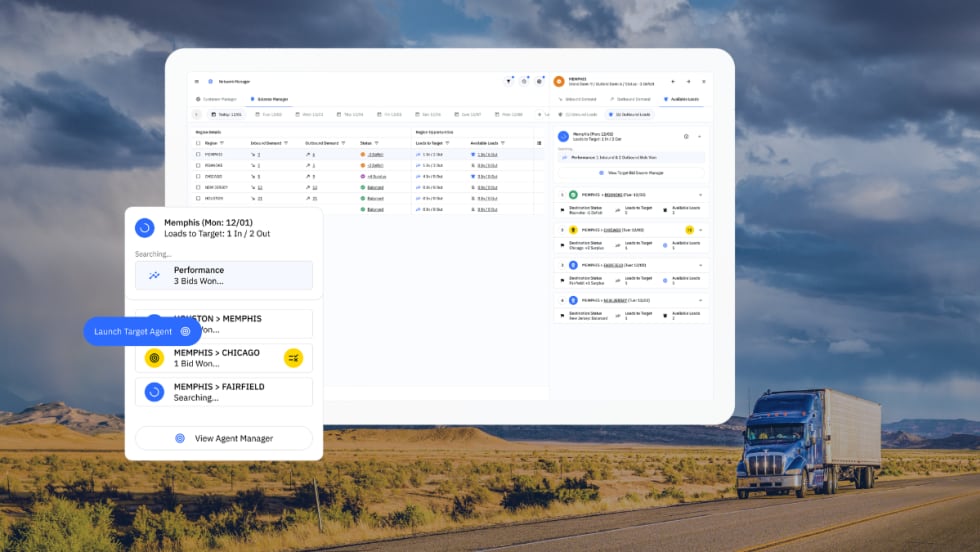

Data can drive decisions about which loads to select.

Photo: Newtrul

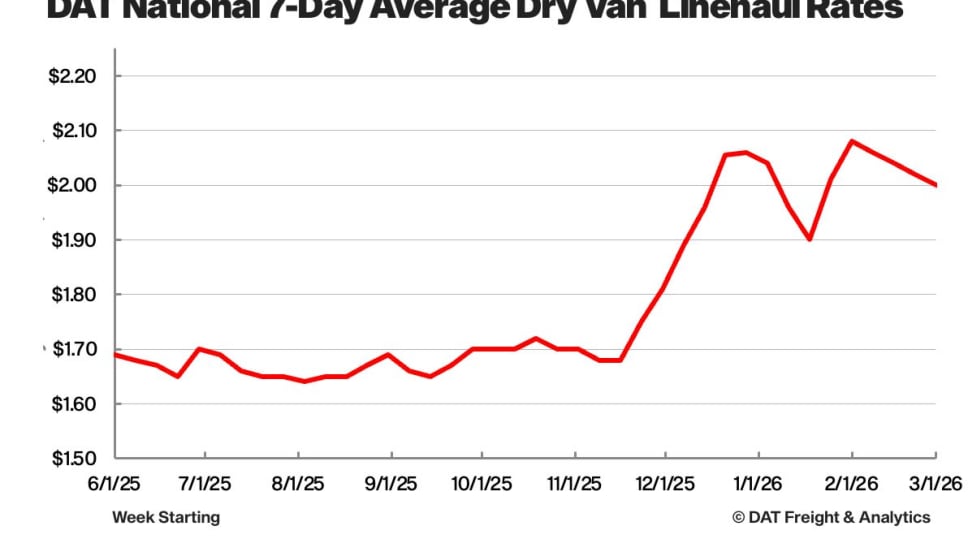

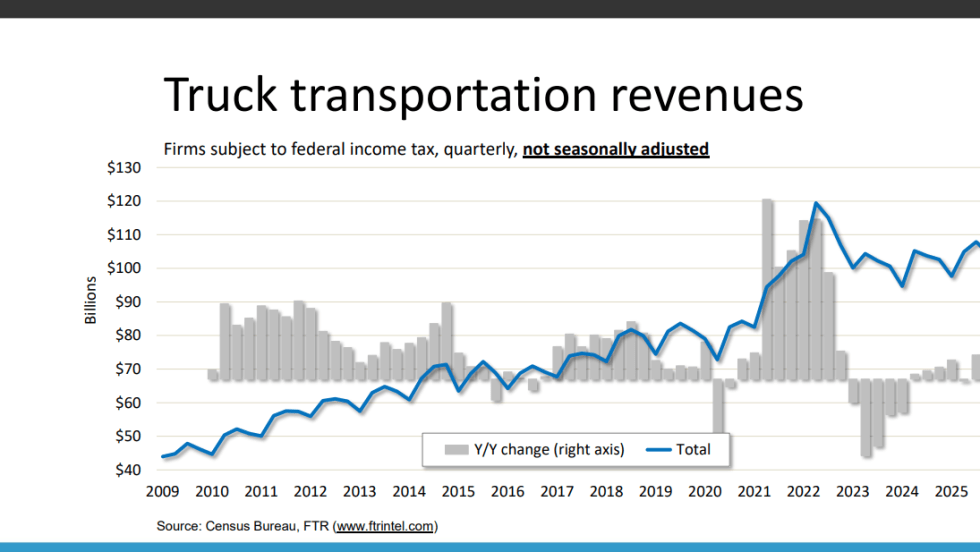

2. Inflationary Effects on Rates

Inflation has been driving down consumer demand — not enough for a recession, but trucking has been feeling the pain.

“Consumers are still spending money and trucks are still moving,” he says. “But the rates truckers are getting paid have fallen 33% to 50% over the last 12 to 18 months. Meanwhile, insurance, fuel, and maintenance costs are higher. Every single cost for trucking companies has gone through the roof, but the price they’re getting paid is down.”

Stockman hopes Newtrul’s technology can alleviate some of this pressure.

“We work to lower operators’ cost to serve so they can focus on revenue and building customer relationships,” he says. “We automate decision-making and low-effort, tedious manual tasks. Everyone is scared about technology and ROI at first. They always think humans can make better decisions until they see technology working in real time. Then they get comfortable with it.”

3. Security Concerns are Growing

Carriers coming to Newtrul share some key concerns, with security being No. 1, Stockman says.

Many motor carriers outsource screen scraping and collect data through optical character recognition to pull into their databases. They now realize these efforts are not secure and something their investors would like them to avoid.

“They ask us how they can access the same information through a secure API connection where both parties have agreed to share that data,” he says. “A timely integration that moves quickly and instantaneously, that is also stable and secure, is incredibly important. Security and speed are typically their top concerns.”

He adds, “The sooner carriers get off marketplaces using analog posting, the better they will be able to expand their reach and expedite efforts to generate revenue and lower cost to serve.”

The industry will always face challenges. But Stockman says technology can provide some answers. Automating key functions will help mid-market freight brokers, carriers and shippers navigate future hurdles while growing efficiencies and scaling their businesses.

Explore the entire collection of 'How Freight Movement is Changing.'

More Fleet Management

DAT Launches iPhone Widget to Help Owner-Operators Find Loads Faster

New DAT One feature shows top-paying loads directly on an iPhone’s home screen, helping carriers react faster to spot-market opportunities.

Read More →

Optimal Dynamics Launches AI System to Help Carriers Choose Better Freight

Optimal Dynamics says its new Scale platform uses AI agents and optimization to help carriers find and secure freight that improves network balance and profitability.

Read More →

DAT: Flatbed Demand Climbs as Van and Reefer Rates Soften

DAT Freight & Analytics data shows tightening flatbed capacity, easing produce markets, and softening van and reefer rates.

Read More →

Run on Less “Messy Middle” Data Shows Multiple Paths Forward for Truck Powertrains [Watch]

NACFE's Run on Less - Messy Middle project demonstrates the power of data in helping to guide the future of alternative fuels and powertrains for heavy-duty trucks.

Read More →

Federal Court Lets NYC Congestion Pricing Continue

A federal court ruling allows New York City’s congestion pricing program to continue, leaving truck tolls in place for fleets delivering into Manhattan.

Read More →

Federal Court Lets NYC Congestion Pricing Continue

A federal court ruling allows New York City’s congestion pricing program to continue, leaving truck tolls in place for fleets delivering into Manhattan.

Read More →

Fontaine Modification Launches Real-Time Truck Modification Tracking Portal

Fontaine Modification has introduced a new customer portal designed to give fleets real-time visibility into the truck modification process, addressing one of the most common questions fleet managers face: “Where’s my truck?”

Read More →

FTR: Trucking Conditions Index Climbs to Highest Level Since 2022

Strong freight rates, rising volumes and tighter capacity push trucking conditions higher, though diesel prices could temper gains in the near term, FTR cautions.

Read More →

Smarter Maintenance Strategies to Keep Trucks Rolling

In today’s cost-conscious market, fleets are finding new ways to get more value from every truck on the road. See how smarter maintenance strategies can boost uptime, control costs and drive stronger long-term returns.

Read More →

ACT Expo 2026 Unveils Speaker Lineup Focused on Real-World Fleet Technology Deployment

Nearly 400 executives and fleet leaders will address AI, autonomy, zero-emission vehicles, and connected technologies at ACT Expo 2026 event in Las Vegas in May.

Read More →