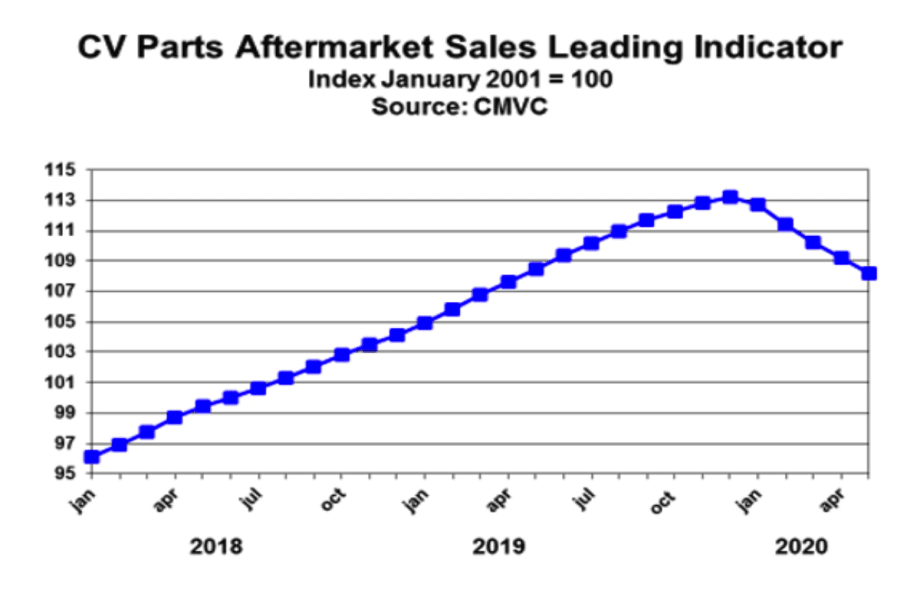

Commercial Motor Vehicle Consulting’s Parts Aftermarket Sales Leading Indicator (PLI) decreased 0.9% in May, making it the fifth consecutive monthly decrease and signaling a weakening parts aftermarket sales environment.

“With the gradually re-opening of the economy stimulating trucking activity, one would think a strong rebound in the parts aftermarket sales,” said Chris Brady, president of Commercial Motor Vehicle Consulting.

PLI was designed by CMVC to be a short-term forecasting indicator of U.S. commercial vehicle parts aftermarket sales by signaling peaks/troughs and inflection/turning points in parts aftermarket retail sales due to changes in the fleet business environment as a result of cyclical changes in the fleet business environment

“PLI, however, is signaling the parts aftermarket sales environment will remain soft in the near term; while trucking activity is increasing, it remains below levels before the coronavirus closed segments of the economy,” added Brady.

While the country and the economy is beginning to re-open, Brady explained that fleets are still struggling with sales that are below the pre-coronavirus period, implying that truck utilization remains below pre-COVID-19 levels as well.

“Utilization of the truck population determines the rate at which trucks depreciate, thereby consume parts,” he said.