Lidar developer AEye’s VP of Trucking Andrew Nelson spoke to HDT about how shakeups in the autonomous trucking space impact technology developers, and the perception and the future of autonomous-vehicle technology.

Q&A: AEye’s Andrew Nelson on Lidar’s Role in Autonomous Trucking

Lidar developer AEye’s VP of Trucking Andrew Nelson tells HDT how shakeups in the autonomous trucking space impact technology providers and explores the perception of the industry.

Lidar developer AEye’s VP of Trucking Andrew Nelson tells HDT how shakeups in the autonomous trucking space impact technology providers, and explores the perception of the industry.

Graphic: HDT, AEye

AEye creates lidar systems, which are an essential component of making autonomous and driver-assisted trucking a reality. AEye’s technology, which is currently available to trucking OEMS through a licensing agreement with Continental, uses software-defined architecture to adapt the lidar sensors to various needs on the road. (Check out “How Do Autonomous Trucks ‘See’ the World?” to learn more about how lidar works.)

Late last year, AEye’s 4Sight lidar platform was selected by a “major trucking platform partner” to use in long-range, hub-to-hub autonomous trucking. The identity of the partner has been delayed, but Nelson assures that the technology is being developed on trucks. He says AEye is engaged in trucking because “there’s a very clear use case on the interstate highways.”

Nelson said the platform is being put to the test on interstates in the Texas Triangle connecting Austin, Houston and Dallas, as well as on Interstate 10 from Florida to California.

These are popular corridors for many major autonomous trucking pilots. For example, Kodiak Robotics is testing its autonomous trucking platform in Texas, along the I-10 corridor to Jacksonville, and in California. Texas has also drawn companies such as Aurora, Gatik, and Waymo, to name a few.

The interview below has been edited for clarity and length.

HDT: The public perception of autonomous trucking seems to be all over the place. You know what goes into these systems. What do you wish people knew about the technology behind it?

Nelson: There's a lot of things I wish people would know, but I'll oversimplify and say this: There are a lot of responsible and conservative companies that have been around for a long time — commercial vehicle OEMs like Daimler Truck or Paccar or Navistar or Volvo — who are currently involved in the testing [of autonomous trucks.] Along with Tier 1’s [suppliers] that have been around trucking for decades. They want nothing more than to go slower than they need to. It's not just this “rush fast and break stuff” that people hear about … The bottom line is the ROI we can deliver on automating is very mundane, boring, and in easy environment areas of the U.S. or the interstate highway.

It will get to a point in the next one to two years where seeing a commercial [autonomous] vehicle is going to be boring. It's going to be boring because the commercial vehicle industry is very conservative. The verification and validation is very careful, and very critical, and that's why you won’t be seeing significant numbers of what they call Level 4 autonomous trucks that can drive themselves on the highways. It's still going to be another three to four years, but it's definitely coming.

HDT: There have been some shakeups among some major players in autonomous trucking. For example, TuSimple and Locomation cutting staff, and reports that Embark is in danger of shutting its doors. How do you view these challenges, and how does the success of these companies impact technology suppliers like AEye?

Nelson: I honestly think it's part of the technology curve. If you ask someone if making a good autonomous vehicle is a software problem or a hardware problem… Well, if you're asking someone in Detroit, they’d say hardware. If you ask someone in Silicon Valley, they’d say software. You know, two years ago there were 78 lidar companies. There's now about 13. It's a natural evolution ... It's very capital-intensive.

With Embark, Locomation, all these companies, there were probably 15 to 18 players one to two years ago. I think that ultimately when we look back in a couple of years, we'll see it's going to settle in with maybe three to five or six players. There'll be mergers and acquisitions. But, like I said, it's very capital intensive. Sooner or later the market is going to speak. And as we all know, in late 2022 into 2023, the market is speaking very strongly about the technology in these pre-revenue companies.

HDT: We’re hearing more about solid-state lidar, which has no moving parts. I know AEye works with solid-state lidar. Why is this important for trucking applications, and do you see rotating lidar sensors being a thing of the past?

Nelson:Solid state is a term referencing when [a lidar system] has no externally rotating parts. You've probably seen the spinning thing on top of cars, as well as Waymo. But a hybrid solid state or solid state is basically a fixed lidar that you mount.

Don't get me wrong, automotive’s had belts and pulleys in their vehicles for 100 years and have found a way to make it work. It's just not easy. But AEye has a fixed field of view, hybrid solid state lidar. These systems are not doing 360 degrees [of view], but they're covering 120 degrees or 150 degrees, along those lines. [Editor’s Note: Nelson says there are some lidar companies focusing on rotating lidar systems, but most prefer to target hybrid solid state lidar.]

I don't think [rotating lidar is a thing of the past.] II mean, the same way they thought cell phones would get rid of Canon cameras, right? There's going to be always a place for that. Maybe not in automotive as much. but when you're looking at monitoring an intersection, and you're trying to see all sides for traffic, pedestrians and smart city applications. There's a lot of use cases.

If it’s stationary, that's one thing. You don't have to worry about the wear and tear when it's moving. And then you also have moving parts and a lot of vibration, a lot of buildup, a lot of challenges. It’s a lot different when you get into rural environments. The speed you’re traveling at, let alone 80,000 pounds, is exponentially more challenging stuff.

HDT: How does AEye’s licensing agreement with Continental work?

Nelson: AEye’s approach is that we license our technology, our IP, our core competency, of building a lidar once, and then we're licensing that to Tier 1 [suppliers] — in this case, Continental. Continental builds it. They’ve been delivering automotive grade components to OEMs, OEMs have trusted them for 150 years. When you talk about licensing, you simply get a percent of the overall deal versus selling directly to the OEM. There's a lot more profit in that. But customers know that Continental knows how to bring a product to market, and they won't rush it if it's not ready. So, the assurance that you have a manufacturing plant, as well as the ability to robustly make this, and you've built products that go into millions of cars already… that's the approach to licensing to a Tier 1. The reason why I hold it near and dear to my heart is because I was a mechanical engineer at Purdue, and so I just know how hard hardware is. And so I just think any lidar company has no business making mass quantities if they’ve never done before.

They’re building it start to finish. We’ve shared how we calibrate the lidar, how we configure it… all the technical parts of it. They are currently building it in Germany at a certain stage of the process. Start of production is going to be in 2025.

More Equipment

Mack Unveils CommandView Safety and Productivity System for Granite

Mack Trucks’ CommandView is a new suite of integrated onboard technologies designed to enhance jobsite safety, improve operational efficiency for fleet operators.

Read More →

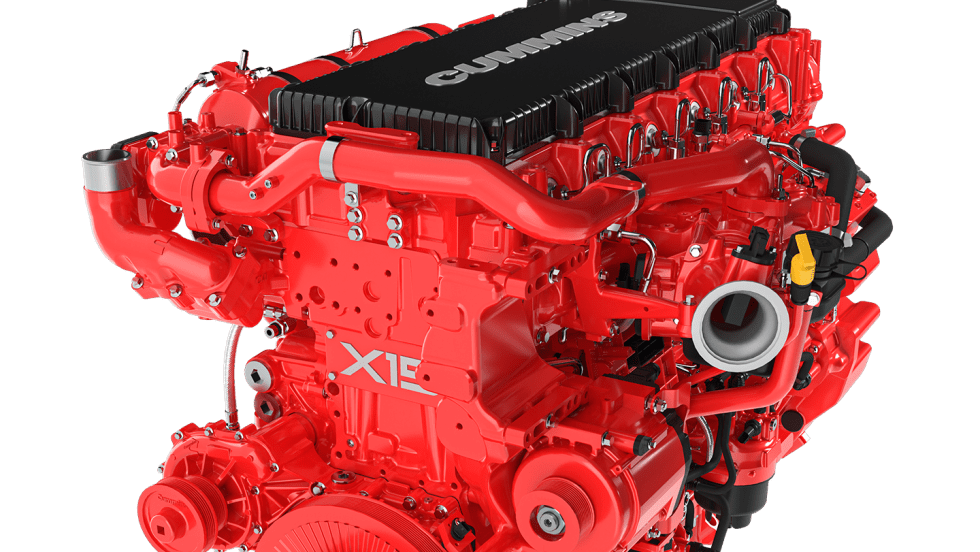

Daimler Adds Cummins Engines to 2027 Powertrain Lineup

Freightliner and Western Star models will offer a broader mix of gasoline, diesel and natural gas engines designed to meet EPA 2027 emissions standards.

Read More →

Smarter Maintenance Strategies to Keep Trucks Rolling

In today’s cost-conscious market, fleets are finding new ways to get more value from every truck on the road. See how smarter maintenance strategies can boost uptime, control costs and drive stronger long-term returns.

Read More →

Peterson to Debut Genesis Fail-Safe Truck and Trailer Light at Major Industry Events

Peterson will debut its new Genesis truck and trailer light at Work Truck Week and TMC.

Read More →

PlusAI Debuts SuperDrive 6.0 With Night Driving, Construction-Zone Capability

The latest version of SuperDrive aims to accelerate path to scalable driverless trucking operations.

Read More →

FTR Reports Class 8 Truck Orders Surged in February

FTR said preliminary Class 8 truck orders jumped 47% month over month and 159% year over year as improving freight conditions and clearer regulatory outlook boost fleet confidence.

Read More →

Kenworth Unveils C580 Extreme-Duty Truck at ConExpo

The new extreme-duty vocational truck replaces the long-running C500 and is designed for the most demanding off-highway applications, with production scheduled to begin in 2027.

Read More →

Mack Debuts All-New Keystone Vocational Tractor, Unveils Reimagined Granite at ConExpo 2026

Mack has debuted an all-new Class 8 tractor and an updated Granite model ahead of ConExpo-Con/Agg 2026.

Read More →

How One Company is Using Smart Suspension Technology to Reduce Driver Injuries and Improve Retention

America’s Service Line adopted Link’s SmartValve and ROI Cabmate systems to address whole-body vibration, repetitive strain, and driver turnover. The trucking fleet is already seeing measurable results.

Read More →

Trailer Orders Hold Steady in January as Backlogs Rebuild

FTR says net trailer orders are flat month over month at 24,206 units, with 2026 orders still trailing last year.

Read More →