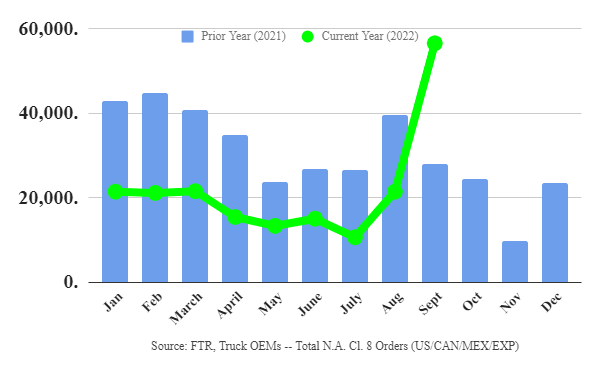

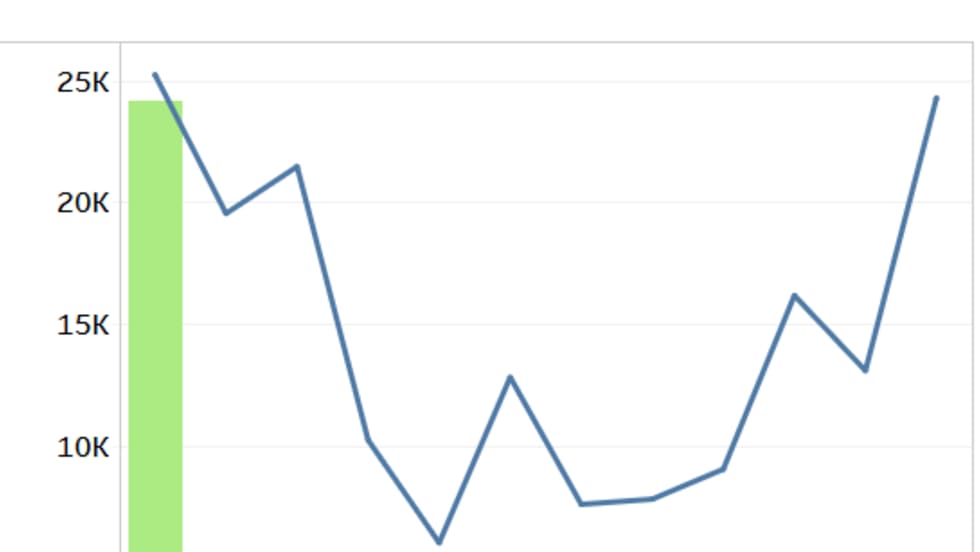

North American Class 8 net orders for September soared to between 53,700 and 56,500 units, the most ever for a single month, according to FTR.

September order activity increased 169% month over month, and 102% year over year, with Class 8 orders now totaling 254,000 units for the last 12 months, according to FTR.

September order activity is further testimony that there remains a tremendous level of pent-up demand, FTR officials said in a press release.

While September’s spike in orders is a positive sign for the industry, according to FTR, build rates continue to be impacted by component shortages as suppliers continue to face supply chain bottlenecks and labor shortages.

“With order boards officially open for 2023 build spots, Q4 monthly order levels will likely be dependent on how far into 2023 manufacturers are comfortable accepting orders amidst an unforgiving supply chain environment that is now expected to persist well into 2023,” Charles Roth, commercial vehicle analyst for FTR, said.

Eric Crawford, ACT’s vice oresident and senior analyst, said the orders were sensational no matter how you slice the data.

Demand continues to put pressure on manufacturers as many dealerships have now indicated that OEMs are now allocating production capacity for 2023 build slots. This is in large part an effort to improve on-time delivery performance while also reducing the impact a potential component shortage may have on production plans, Roth added.

Dealers have indicated that as a result of component availability they have had orders pushed out into the future or delayed as a result of red tag units having to be finished off-line.

“Fleet confidence remains solid entering 2023, as many large national fleets are getting their truck orders in as early as possible for next year's deliveries,” Roth said. “Due to the limited availability of new equipment fleets have not been able to phase out aged equipment over the past two years. As a result, we anticipate replacement demand to stay elevated throughout 2023.”