North American Class 8 commercial vehicle preliminary net orders for June remained soft, according to two major industry research firms.< Net orders for Classes 5-7 also fell below trend, but the decline was expected, as medium-duty activity typically tapers off during the summer months.

ACT Research predicts the final numbers, which will be released mid-July, will approach 16,500 units for heavy-duty Class 8 trucks and 12,900 for medium-duty Classes 5-7 vehicles. The preliminary net order numbers are typically accurate to within 5% of actual.

FTR Associates's June data shows Class 8 truck net orders at 16,195 units, the lowest month for orders since September 2010. June orders were 8% lower than May, dropping to 23% lower than the same month last year. 2012 orders for Class 8 trucks continue to disappoint, FTR said in a press release, with annualized rates coming in well below 2011 levels month after month. For the three-month period including June orders annualize to 202,700 units.

"The explanation for the soft patch remains of the 'death by a thousand cuts' variety," says Kenny Vieth, president and senior analyst, ACT Research. "As has been the case since late February/early March, the issue appears to boil down to credit-buying truckers' confidence in the economy relative to the risk of taking out a sizeable loan to buy a truck. To that end, risk, economic or political, domestic or global, remains high, and memories of 2009 are still fresh."

Jonathan Starks, FTR's Director of Transportation Analysis, commented that, "truckers are operating in a modestly positive environment, but not strong enough to elicit higher demand for expensive new vehicles. Growth in freight volumes and rates slowed noticeably during late 2011 and into 2012. Despite expectations that both will improve as we finish 2012, equipment markets will have to contend with the effects of last year's slowdown. Additionally, truck manufacturers continue to build at rates well above incoming orders. This will eventually lead to a significant reduction in new truck output."

Class 8 Preliminary Net Orders Remain Soft; Classes 5-7 Fall Below Trend

North American Class 8 commercial vehicle preliminary net orders for June remained soft, according to two major industry research firms.< Net orders for Classes 5-7 also fell below trend, but the decline was expected, as medium-duty activity typically tapers off during the summer months

More Fleet Management

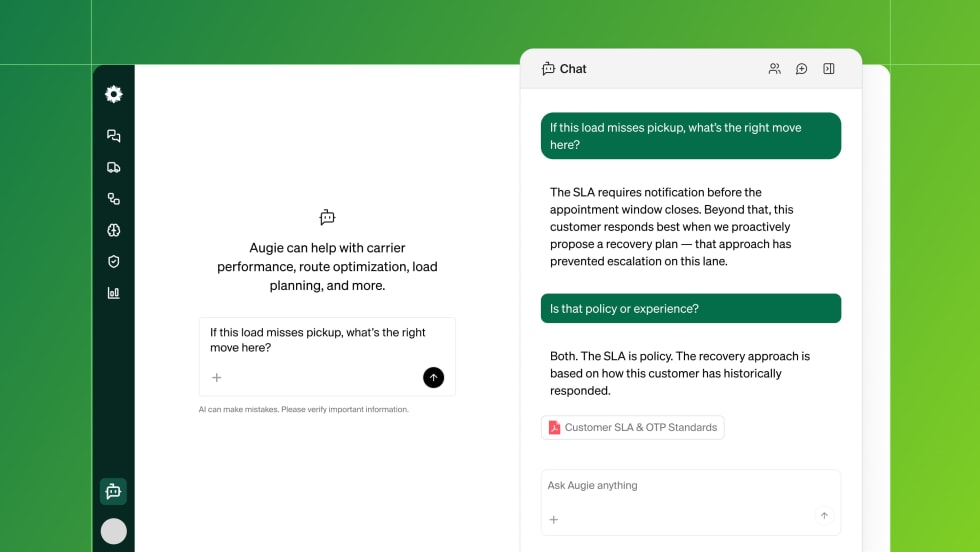

Augment Launches Freight-Native Knowledge Hub to Preserve Operational Know-How

Knowledge Hub is designed to turn scattered tribal knowledge into execution-ready intelligence and help logistics teams make faster, more consistent decisions.

Read More →

FTR: Trucking Conditions Hit Four-Year High as Rates and Capacity Tighten

Improving freight rates and tighter capacity push FTR’s Trucking Conditions Index to its highest level in nearly four years.

Read More →

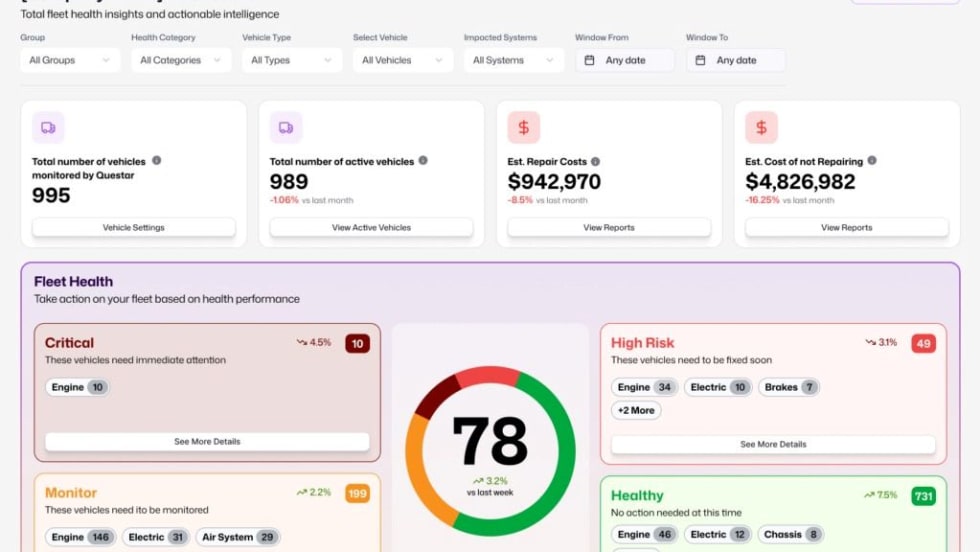

Questar Predictive Fleet Health Platform Now Available Through Geotab Marketplace

Quester’s AI-driven maintenance insights aim to help fleets reduce unplanned downtime, improve repair planning, and better understand the true cost of maintenance decisions.

Read More →

Truckload Carriers Association Names Jim Mullen President

Mullen has trucking experience with government, associations, trucking companies and suppliers.

Read More →

Trucking the Super Bowl: How Super Bowl LX Impacted Freight Volumes

Super Bowl LX drove a spike in trucking freight volumes into San Jose. New data shows which equipment types benefited most.

Read More →

How Cybercrime Is Reshaping Cargo Theft and Fleet Risk in 2026

Artificial intelligence is changing how cybercriminals and cargo thieves target trucking fleets—and how fleets defend themselves. As phishing, impersonation, and cargo theft converge, cybersecurity is becoming a core part of fleet safety and operations.

Read More →

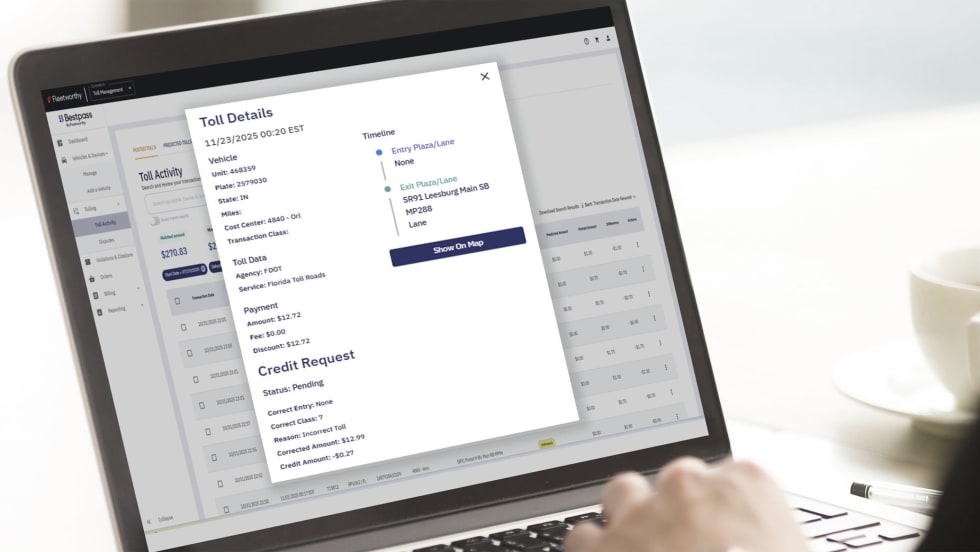

Fleetworthy's AI-powered Toll360 Gives Fleets Real-Time Toll Visibility and Automated Dispute Handling

Fleetworthy's new Bestpass Toll360 add-on uses route data and AI to predict toll charges, reconcile invoices, and automatically file eligible disputes—helping fleets cut manual work and recover overpayments.

Read More →

Mack Financial Services Launches Physical Damage Insurance For All Makes

Mack Financial Services has introduced the Rolling Asset Program, offering physical damage insurance for all makes and models within a customer's fleet.

Read More →

New Phishing Scheme Targets Motor Carriers, FMCSA Warns

Beware of a new phishing scheme targeting motor carriers. Scammers are sending emails posing as FMCSA or DOT officials to steal data.

Read More →

DTNA Partners with Class8 to Expand Digital Services for Freightliner Owner-Operators

A new partnership brings free wireless ELD service plus load optimization and dispatch planning tools to fourth- and fifth-generation Freightliner Cascadia customers, with broader model availability planned through 2026.

Read More →