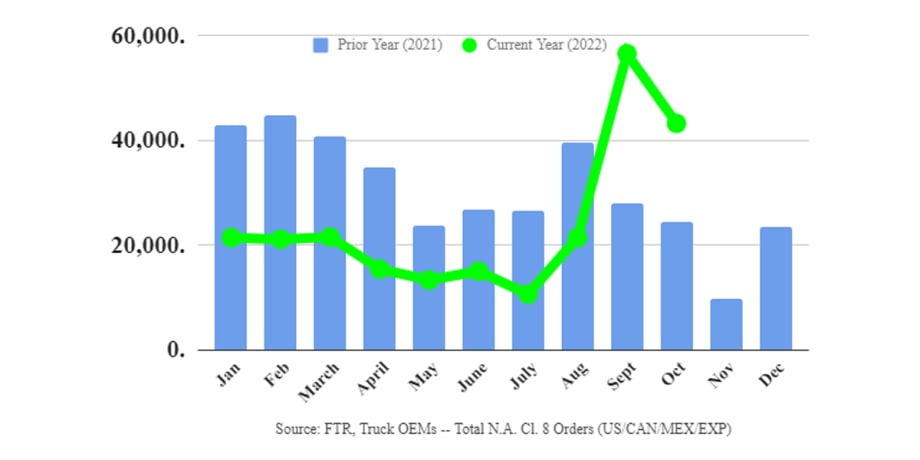

Elevated truck orders in October means there is still a tremendous amount of pent-up replacement demand in the Class 8 market due to the constricted production environment of the past two years that has limited many fleets from replacing aged equipment, FTR officials reported.

North American Class 8 net orders for October remained elevated for the second consecutive month, coming in between 42,500 and 43,200 units, according to ACT Research and FTR data, respectively.

October order activity was down 23% month over month, but up 77% year over year, with Class 8 orders now totaling 271,000 units for the last 12 months, FTR officials wrote in a press release.

“OEMs are now filling build slots well into Q2 and the early part of Q3 2023,” Charles Roth, commercial vehicle analyst for FTR, said. “Component shortages continue to be a week-to-week issue; however, the overall sentiment from manufacturers is optimistic that improvements will be made in the coming months and throughout the first half of next year.”

Roth says October was the turning point for the Class 8 market.

“While we face headwinds in the freight market, overall fleet sentiment remains optimistic,” he said. “While some OEMs have indicated that they have implemented allocation plans for dealers, the retail channel is another segment of the market that has yet to be able to maintain sufficient levels of inventory due to the limited availability of supply.”

With two strong months of net orders, there is the potential for a gradual decrease month over month in net orders as we close out the year, he said.

“We continue to expect a freight recession, and an eventual economic recession (mild to medium in magnitude), but OEMs at this point have clear visibility to a strong [first half of 2023] (barring any unforeseen cataclysmic events),” said ACT’s Vice President and Senior Analyst Eric Crawford.