The U.S. economy is expected to grow 7.7% this year, largely on the strength of higher vaccinations rates and the country’s slow but steady return to normal life.

In 2020, not surprisingly with the coronavirus pandemic dragging down the economy, U.S. business logistics costs (USBLC) dropped 4% to $1.56 trillion-- or just 7.4% of 2020’s $20.94 trillion gross domestic product (GDP). On the other hand, the U.S. economy is now expected to grow 7.7% this year, largely on the strength of higher vaccinations rates and the country’s slow but steady return to normal life.

That’s per the Council of Supply Chain Management Professionals’ (CSCMP) 32th annual State of Logistics Report, whose authors observe that, “The pandemic caused global supply chains to suddenly stop. Then to start again, haltingly. Then to be rerouted, sometimes stopping again, sometimes facing capacity shortages or price increases, often stymied by unexpected bottlenecks. Stay-at-home consumers increased demand for last-mile deliveries.”

The CSCMP report was released virtually on June 21. Presented by Penske Logistics, the report is authored each year by consultancy Kearny.

The report is subtitled “Change of Plans,”reflecting how despite the pandemicand other disruptions, adjustments in supply chains are ongoing to ever adapt to manufacturers shifting their sources and consumers adjusting their spending behaviors. The report’s authors note that change in supply chains also comes courtesy of a trend to multi-shoring (tapping service providers in different countries) and an “emphasis on optionality” (a state in which choice is allowed) at the expense of running “lean and optimal.”

“Logisticians came off the ropes of a bruising 2020 with a new appreciation” for how resilience driven by their capabilities had “got them through the main disruptive rounds of the pandemic,” said report presenter Michael Zimmerman, partner at Kearney. He added that now “2021 is confirming that the ability to change plans and execute under adversity has risen to be the top priority.”

Picking up on that theme, Andy Moses, senior vice president of sales and solutions for Penske Logistics, remarked that, “Resiliency, innovation, technology, and close collaboration with shippers have all been essential to weathering the rapidly changing market demands up and down the supply chain. We see this continuing as supply chains reset and adjust to a new normal” determined by consumer preferences and expectations.

The 72-page report dives deeply into how logistics was essential to fighting the pandemic, even before vaccines were available. “Yet the pandemic made shippers’ and carriers’ assets less efficient and destroyed any idea of predictability,” the authors point out. “While service outcomes largely deteriorated, logistics was remarkably effective given the disruptions.”

Key findings

Indeed, the authors state that the “K-shaped” economic recovery of 2021mirrors changed consumer habits. For example, while the hospitality, restaurant, and airline segments struggled, grocery retail, home improvement and e-commerce sectors prospered. As for e-commerce purchases (some of which were picked up in-store) grew by 33% to $792 billion, representing 14% of all retail sales.

The report holds that the “control tower concept” is taking on an added importance in logistics management, as “resilience is most effective when paired with visibility.” Because companies need knowledge to make quick decisions, modeling the dispersal of information as a control tower improves “planning and reacting.”

Efforts to boost sustainability in the transportation sector are increasing, even as consumers become more likely to weigh the environmental impacts of their purchases and governments across the globe draw up more stringent regulations.

The authors also contend that, moving forward, “supply chains must continue to provide goods and services to the American public while dealing with tight capacity and volatile rising rates; H1 [first half of] 2021 has the highest rates the market has ever seen.”

While the U.S. economy shrank by 3.5% in 2020, both the global and U.S. economies are recovering, with the global recovery as strong or stronger than the U.S. recovery, per the report. Kearney predicts 6.3% global growth in 2021, tapering to 4.6% and 3.1% in 2022 and 2023, respectively.

Meantime, the U.S. economy is forecast to grow by more than 7.7% in 2021 before slowing to 4.5% in 2022.

“Recoveries always play off abysmal GDP numbers of a recession, but these forecasts suggest a recovery coming more quickly than was expected in early 2020,” stated the authors.

Impact on motor carriers

What does this all mean to motor carriers? A lot. Of course, carrier volumes and rates fell early in the COVID-19 pandemic. Fortunately, inventory replenishment and supply chain restarts then drove growth through the second half of 2020.

And now the continued economic recovery, inventory replenishment, and e-commerce growth will “clash with capacity constraints to keep rates high through 2021,” per the report. “After a steep drop in March and April 2020, freight volumes made a steady recovery through the summer. By early 2021, the Cass Freight Index showed year-over-year (YoY) growth.”

The recovery pushed increased demand for full truckload, less-than-truckload, and intermodal alike. But, as the report points out, “there were imbalances across sectors, and challenging weather conditions further scrambled the winter picture.” All told, rates in 2020 were “more volatile than ever, tender acceptance was at record lows, and more freight was pushed to the spot market.”

The report also delved into structural issues affecting trucking. For one, poor carrier finances in 2019 and early 2020 reduced carrier investments in new equipment. So, fewer new trucks were available to meet the rising demand in late 2020 and early 2021. Carriers are now increasing their orders for Class 8 trucks, with 2021’s first-quarter orders already at 45% of all 2020 orders.

“However, additional structural and cyclical headwinds may continue to constrain capacity” the authors contend. One factor is the availability of new trucks as pandemic shutdowns slowed production, even to the point that aftermarket parts supplies have been constrained.

On top of that, the authors expect the Biden administration to revisit hours of service and other driver rules, such as mandating that drivers be paid for detention, likely at the cost of the shippers. “Reducing detention could merely drive up prices for end consumers,” the report argues “But ideally, it will increase overall capacity, as shippers will be forced to adjust their behaviors rather than incur costs. Drivers can then spend their time in more direct trucking functions rather than waiting at a facility.”

Of course, the driver shortage hasn’t gone anywhere. Early in the pandemic, carriers downsized to stay afloat but later some struggled to rehire enough drivers. In addition, the launch last year of the federal drug and alcohol clearinghouse reduced available drivers. The report notes that “initial studies show that a large majority of the nearly 30,000 drivers in the clearinghouse do not quickly complete the steps required to allow them to get back behind the wheel.”

Good news

On the good news side of the ledger is refrigerated freight. Increased demand for refrigerated goods will cause the reefer sector, especially the multi-zone truck segment, to grow faster than the industry average. “The growth creates opportunities for investments that could benefit refrigerated trucking companies and perishable food manufacturers.”

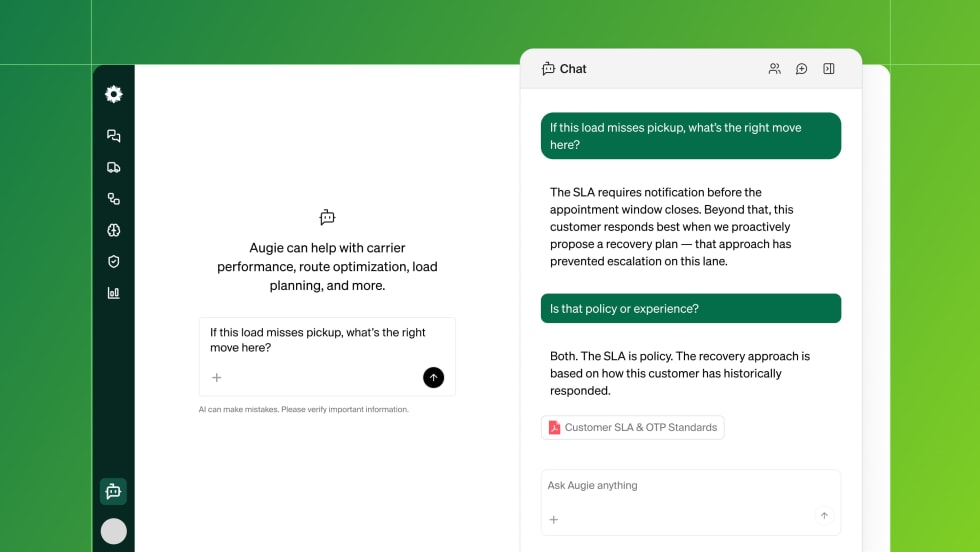

Another positive is that the pandemic-driven desire for more “no touch” processes “broke through some of the longstanding resistance to digitization. Electronic communication has gone from desirable to necessary.” The authors see the most promising aspect of digitization being greater efficiency of LTL loads. In addition, the market continues to move to online brokers and online freight booking. “Online platforms allow shippers and carriers to do their transactions in a shared access space. New digital matching functions give carriers the ability to place offers on loads, as well as increasing their flexibility. The brokerage market size is expected to more than double by 2024, largely due to the increased digitization.”

Also thanks to COVID-19, parcel and last-mile delivery volumes have exploded. In 2020, the U.S. e-commerce market expanded by 33%, to $792 billion. That represents 14% of total U.S. retail sales. “This change in consumer behavior categorically disrupted parcel and last-mile delivery networks.”

In response to demand, last-mile delivery models are rapidly evolving. For example, crowdsourced delivery solutions, such as Instacart or Amazon Flex, are expanding. Also, fully autonomous delivery options, such as Nuro and General Motor’s BrightDrop, are growing. The expanding number of last-mile delivery solutions continues to attract increasing investment and acquisition interest.

One way to sum up the report is to consider a key point made by the authors: “No logistician was able to simply stay the course in 2020, and conditions ahead will require even greater adaptability and nimbleness, a context we summarize as change of plans.”