Dan Funkhouser, Yokohama Tire’s vice president of commercial tire sales, recently discussed the current state of the truck tire industry and what to expect moving forward.

Q:Industry-wise and for Yokohama, did 2019 play out the way you expected?

Dan Funkhouser, Yokohama Tire’s vice president of commercial tire sales, recently discussed the current state of the truck tire industry and what to expect moving forward.

Yokohama Tire’s Dan Funkhouser discusses the commercial tire industry's past year and his outlook on the future.

Photo: Yokohama Tire

Dan Funkhouser, Yokohama Tire’s vice president of commercial tire sales, recently discussed the current state of the truck tire industry and what to expect moving forward.

Q:Industry-wise and for Yokohama, did 2019 play out the way you expected?

Dan Funkhouser: Yes and no. The replacement business was a little soft, as predicted, due to the expected increase in OEM business. However, OE tractor sales were mixed. They were extremely strong until the third/fourth quarter then slowed down, only to have a sudden increase in late November/December.

Q:What surprised you most about the market last year, and why was the market flat?

Funkhouser: The oil field business did not do quite as well as expected, which was a surprise. As for the commercial tire market, the USTMA replacement segment was reported as being down roughly three percent compared to 2018. Some of the headwinds for 2019 replacement sales were heavy inventories in the market to start the year, uncertainty related to Chinese trade and tariffs, the delay in signing the United States – Mexico – Canada Agreement, the influx of new equipment and some acquisitions. This all lead to a bit of uncertainty and conservative purchases.

Q: Generally speaking, how did Yokohama do and why?

Funkhouser: For Yokohama, 2019 was very similar to 2018. The introduction of new products such as the 114R UWB, 712L and 715R helped us grow in markets we had not been able to in the past.

Q: What were the effects of the Chinese tariffs?

Funkhouser: The effects of the 2018 tariffs lead to large amounts of product in the market. The trade tariffs caused a slowdown in farming and production, thus having a negative effect on the market.

Q: What other changes did you see in the industry?

Funkhouser: There were a lot of mergers and acquisitions in 2019. This caused dealers to absorb inventory, which in turn, slowed down their purchases. There was an increase in fleets filing for bankruptcies in 2019 compared to 2018. This has caused credit to be harder to get.

Q: Will there be more industry mergers/acquisitions in 2020?

Funkhouser: Yes, we will continue to see mergers and acquisitions in all segments of our business: fleet, dealer and truckstop. This is due to the demands of customers, those who use trucks and those who service them.

Q:What other things are on tap for the industry in 2020? Any new trends to watch for like last-mile delivery, electric trucks and self-driving trucks?

Funkhouser: Last-mile delivery will continue to expand. There has been an increase in the numbers of Sprinter-type [van] vehicles on the road. They continue to deliver to the actual end point. J.B. Hunt has just purchased a last-mile delivery fleet and I believe this will lead to more acquisitions of those types of fleets by the large, over-the-road fleets.

Q: Any new sectors to watch?

Funkhouser: We will continue to see a proliferation of smaller vehicles capable of delivering the last mile to the ultimate user of the product.

Q:Are you concerned about industry issues such as driver retention, legislation, infrastructure and/or the economy, and how they could have a major impact on the market this year?

Funkhouser: Yes, but we cannot control those things. Yokohama is extremely capable in adapting to the changing market, where there’s always opportunities. Partnering with the premier players in our industry allows us to be informed of market trends and new market opportunities. Our manufacturing facility in West Point, Mississippi, permits us to develop and manufacture products for the North American markets. Having a U.S. facility allows us to adjust our production to meet the market’s demand and react to changes in a timely manner. Yokohama’s focus is to continue to be the best supplier in the tire industry to all of our business partners.

As for driver retention, it continues to be an issue but has increased due to low unemployment in the country.

Q: Do you think the Coronavirus will have any effect on the trucking industry here in the U.S.? If so, how?

Funkhouser: I think the impact of the virus may have a negative effect on the trucking industry in a few areas. Production in China is down because people are staying home from work for fear of spreading the virus. Travel within the country is limited making more difficult to get materials and finished products to the plants and ports. As countermeasures to stop the virus from spreading increase, shipments to and out of major Chinese ports continue to drop. This could translate into fewer products to ship here in the U.S.

Q: What’s the one thing that will affect the commercial tire market the most this year?

Funkhouser: OEM demand will have a big impact on tire supply and replacement tire demand.

Q: Will the presidential election have any effect?

Funkhouser: Uncertainty always leads to caution in the market.

Q: What’s new for Yokohama in 2020?

Funkhouser: 2020 will be a very busy and exciting time for Yokohama as we will launch a number of new products throughout the year. This includes new sizes of our popular, Mississippi-manufactured 715R open shoulder regional drive tire: 295/75R22.5 16-ply, 284/75R24.5 16-ply and 11R24.5 16-ply. We’ll introduce the 504C, which is a new on/off road tire available in 11R22.5 and 11R24.5 sizes, both 16-ply. The 714R is our new pickup-and-delivery drive tire offering, and will be available in 225/70R19.5 14-ply and 245/70R19.5 16-ply sizes.

Plus, there’s the new 115R all-position pickup truck tire in 225/70R195 14 ply, and the 505C, which is our next-generation wide base on/off road tire in 385, 425 and 445 sizes. Some of these new products will be on display at March's TMC show in Atlanta.

Q: When it comes to tires, what should fleets be looking for?

Funkhouser: Simple: the lowest cost of total ownership. This is not to be confused with 'cheap.' Rather, it encompasses the longevity in original mileage and casing life, fuel-efficient products that provide the best rolling resistance in original life and the most fuel-efficient casing, and products that are available when and where they need them.

The companies also said they plan to coordinate deployment planning across priority freight corridors and define routes and operational design domains for U.S. commercial service while laying the groundwork for expansion into key European markets.

Read More →

6 intelligent dashcam tactics to improve safety and boost ROI

Read More →

Volvo Trucks held onto the top spot in Europe’s heavy-duty truck market for the second straight year.

Read More →

Previous Star Nation events have included driver challenges, exclusive access to Daimler Truck North America facilities and hands-on experiences with the latest Western Star X-Series lineup.

Read More →

HayWay Group comprises 19 companies operating across Europe and the U.S. and is now bringing its international logistics experience to North America.

Read More →

Safety, uptime, and insurance costs directly impact profitability. This eBook looks at how fleet software is evolving to deliver real ROI through proactive maintenance, AI-powered video telematics, and real-time driver coaching. Learn how fleets are reducing crashes, defending claims, and using integrated data to make smarter operational decisions.

Read More →

Fleet software is getting more sophisticated and effective than ever, tying big data models together to transform maintenance, safety, and the value of your existing tech stack. Fleet technology upgrades are undoubtedly an investment, but updated technology can offer a much higher return. Read how upgrading your fleet technology can increase the return on your investment.

Read More →

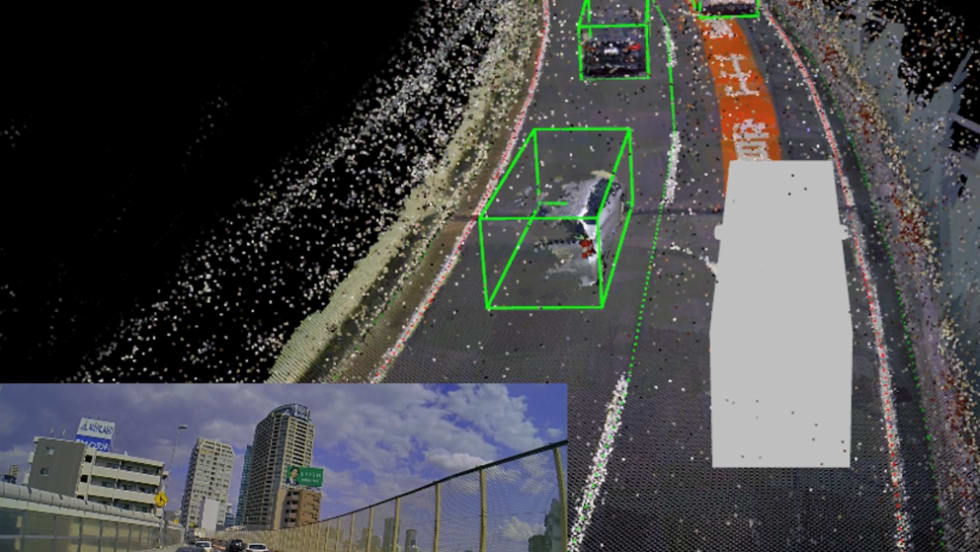

PlusAI is seeking to relieve Japan’s acute truck driver shortage by accelerating the adoption of autonomous trucks in the country.

Read More →

Freightliner’s fifth-generation Cascadia earned a 2025 Red Dot Design Award for its aerodynamic design and functional updates developed through close collaboration between designers and engineers.

Read More →

Mack’s new Anthem Class 8 tractor targets regional-haul fleets with enhanced maneuverability and fuel economy gains.

Read More →