My, how things change. A year ago, investment money in the automotive industry was largely flowing to electric vehicle OEMs and technology companies.

Today? Those investment dollars are flowing into autonomous vehicle technology.

As truck orders lag and EV investment dollars fade away, McKinsey & Company sees autonomous tech moving closer to reality.

Attendees at CES 2026 check out the Kodiak Robotics autonomous truck in the Bosch booth.

Photo: Jack Roberts

My, how things change. A year ago, investment money in the automotive industry was largely flowing to electric vehicle OEMs and technology companies.

Today? Those investment dollars are flowing into autonomous vehicle technology.

One reason for this, as I often say, autonomous technology is a “party trick” in the passenger car market. But there is a solid, compelling business case for autonomous commercial vehicles.

Typically, new technology finds a foothold in luxury cars. Over time, it filters down into more modest family vehicles before finally landing in commercial vehicles.

But in this instance, trucking appears to be taking the lead in bringing this revolutionary new technology to the automotive industry as a whole.

For all the gloom hanging over new-truck orders and the broader freight economy, McKinsey & Company offered one clear counterpoint at CES 2026: Autonomous trucking is one of the few areas in the commercial vehicle space where momentum is building instead of fading.

In a roundtable discussion with trucking journalists at CES 2026 in Las Vegas, McKinsey partner Moritz Rittstieg noted that autonomous trucking technology is advancing faster than it has in years.

Why McKinsey Thinks There is Hope for a Stronger 2026 in Trucking

Commercialization is tightening around a small set of lanes, mostly in the American Southwest. And, he said, investors are suddenly very interested in this new technology again.

Even with all that positive news, Rittstieg kept coming back to the same fulcrum point: The economics of autonomous trucking must work for fleets. Because fleets, not venture capitalists, ultimately have to scale this technology and make it work in real-world freight-hauling applications.

Rittstieg described autonomous commercial vehicle technology as “more exciting” today. He sees tangible signs of acceleration, especially compared to a few years ago, when introduction timelines kept getting pushed back year after year.

There are increasing signs that investors see enormous potential in autonomous trucking technology.

McKinsey’s day-to-day work includes tracking investor interest and the opportunities tied to autonomous tech companies. And the conversation around autonomous trucking has shifted in the past several months, he said. No longer are people speaking about self-driving trucks in a purely speculative manner

Instead, there is a new focus on what’s investable and what possibilities are becoming viable as autonomous technology approaches the dawn of real-world commercial operations.

Another positive sign Rittstieg points to is what he called the “second-order effect.” These are companies that are looking beyond the autonomous technology developers themselves.

Now, he said, companies and investors are beginning to consider everything else that must be in place for autonomous trucking to scale: support infrastructure, fleet management platforms, and service ecosystems focused on autonomous truck operations.

“This is the ‘second-order effect’ where companies try to understand what else needs to happen for a new technology to become a commercial reality,” Rittstieg said.

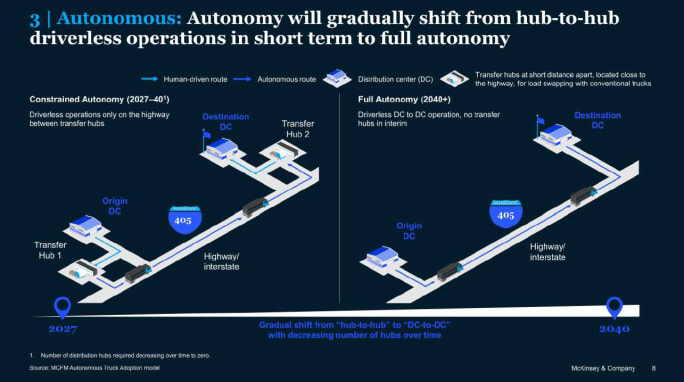

The near-term model for autonomous trucks is hub-to-hub. But what happens long term?

Source: McKinsey & Company

That kind of ecosystem-building is a subtle but important tell, he noted.

“When an industry is purely hype,” he said, “everybody invests in the shiny object. When an industry starts to look real, money starts flowing into the plumbing."

“When an industry is purely hype, everybody invests in the shiny object. When an industry starts to look real, money starts flowing into the plumbing."

Rittstieg pointed to two drivers behind what he called a “factual acceleration” on the technology side.

The first is modern AI techniques. He specifically referenced large language models and the broader surge in AI capability that is changing how people think about perception, decision-making, and edge-case handling.

Secondly: A tighter commercialization focus. Instead of trying to boil the ocean, autonomy developers are narrowing in on a few, specialized routes — again, typically in the American Southwest — where weather, regulations, and operational consistency are more favorable for the continued development of the technology.

With that combination of AI acceleration and a focused operating footprint, Rittstieg said the industry is beginning to see commercial operations mature. And that, in turn, should lead to more scaling of the technology over the next few years.

In McKinsey’s view, North America is the best market for autonomous trucking in the world.

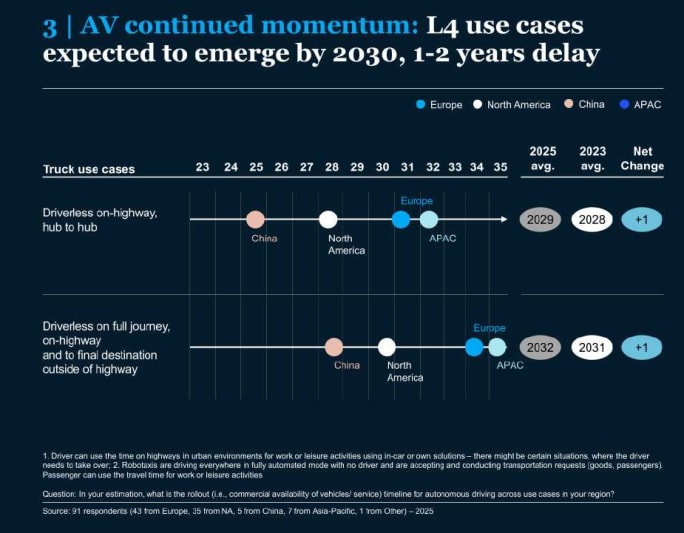

Rittstieg said the U.S. sits ahead of Europe in adoption timelines. Even better, he said, "the pace of technology development and signs pointing to imminent operational deployments are now clearer than they were just a few years ago.”

In other words, the trucking industry no longer appears to be stuck in a pattern where the timeline for autonomous trucks is routinely extended for an additional two or three years.

“Autonomous goalposts have moved a lot over the past decade,” he said. “But now, we’re seeing a slight shift toward eventual deployment – perhaps as soon as next year.”

That doesn’t mean autonomy is imminent everywhere, he cautioned. It does, however, mean that the market is converging around the viability of autonomous trucks as real operational tool for fleets.

McKinsey’s expectation is that the first real beneficiaries of autonomous truck technology will be the most sophisticated North American fleets.

These will be fleets with the scale, data discipline, and operational maturity to integrate autonomy into their networks without breaking their business.

North America is ahead of Europe when it comes to autonomous-truck development.

Source: McKinsey & Company

“Our assumption is that the sophisticated fleets will be the first that adopt it,” Rittstieg said, “and they will be able to run with it and gain a competitive advantage that’s going to be hard to match.”

He suggested adoption could then “trickle through” once the Tier 1 fleets demonstrate advantages in multiple operational areas.

In other words: Autonomy, at least in its early commercial form, may widen the gap between the haves and have-nots. The biggest fleets get better economics and better service offerings first, and the rest will be forced to adopt later — if they can.

Rittstieg also raised a broader point that doesn’t get enough airtime: Autonomous technology will change how today’s freight networks are designed, not just how trucks are operated.

He pointed to one example: How carriers today have reshaped freight networks to get drivers home, build relay points, and structure freight flows to match human schedules.

A driver-out trucking world erodes much of that logic.

That’s one reason Rittstieg said the speed of adoption could surprise people. If autonomy enables different freight network designs — fewer relays, tighter transit times, different lane economics — it becomes more than a labor-replacement tool. It becomes a competitive weapon.

But, I asked Rittstieg, what happens after autonomous truck technology scales?

What happens when truck OEMs decide the technology is safe enough and mature enough to stop retrofitting human-centric tractors and start designing purpose-built autonomous trucks?

Rittstieg agreed that today’s autonomous trucks are being developed as retrofit technology on vehicle platforms designed for human drivers. And that reality, in turn, creates design inefficiencies.

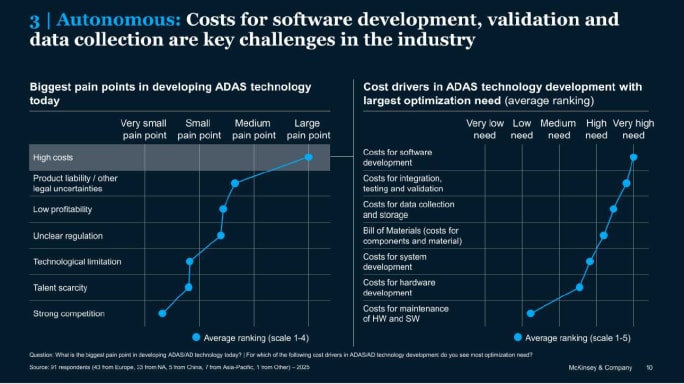

High costs are the biggest pain point for autonomous-truck adoption.

Source: McKinsey & Company

The North American Council for Freight Efficiency estimates that up to 40% of the weight of a modern Class 8 tractor is dedicated to keeping its human occupants safe, productive, and comfortable.

So what happens when a driver is no longer needed, and OEMs can shift that weight to additional payload, reshape aerodynamics, and fundamentally redesign the truck as an optimized self-driving vehicle?

That’s a long-term thesis, Rittstieg said. But it matters because it suggests autonomy’s biggest value might not show up in the first wave.

“The first wave may be about limited-lane operations and operational feasibility,” he noted. “But the second wave could be about completely different trucks and completely different freight economics.

McKinsey’s view of autonomous trucking in North America today is not that the finish line is visible. But rather, the industry is now moving forward on autonomous technology in a way that feels more grounded than in past years.

The technology is advancing, Rittstieg said. Commercial operations are narrowing into specific lanes. Investors are re-engaging. And the ecosystem around autonomy is beginning to form.

But he cautioned, the technology still hinges on one central question: Can fleets make enough money — and capture enough value from autonomous tech — to justify writing the checks that turn a handful of autonomous trucks into thousands?

Related: How Bosch and Kodiak Plan to Scale Self-Driving Trucks

A new partnership brings free wireless ELD service plus load optimization and dispatch planning tools to fourth- and fifth-generation Freightliner Cascadia customers, with broader model availability planned through 2026.

Read More →

This white paper examines how advanced commercial vehicle diagnostics can significantly reduce fleet downtime as heavy duty vehicles become more complex. It shows how Autel’s CV diagnostic tools enable in-house troubleshooting, preventive maintenance, and faster repairs, helping fleets cut emissions-related downtime, reduce dealer dependence, and improve overall vehicle uptime and operating costs.

Read More →

6 intelligent dashcam tactics to improve safety and boost ROI

Read More →

The $283 million acquisition of FirstFleet makes Werner the fifth-largest dedicated carrier and pushes more than half of its revenue into contract freight.

Read More →

B2X Rewards is a new, gamified rewards program aimed at driving deeper engagement across BBM’s digital platforms, newsletters, events, and TheFleetSource.com.

Read More →

Trucking’s biggest technology shifts in 2026 have one thing in common: artificial intelligence.

Read More →

Why discipline, relationships, and focus have mattered more than size for smaller trucking fleets during the freight recession.

Read More →

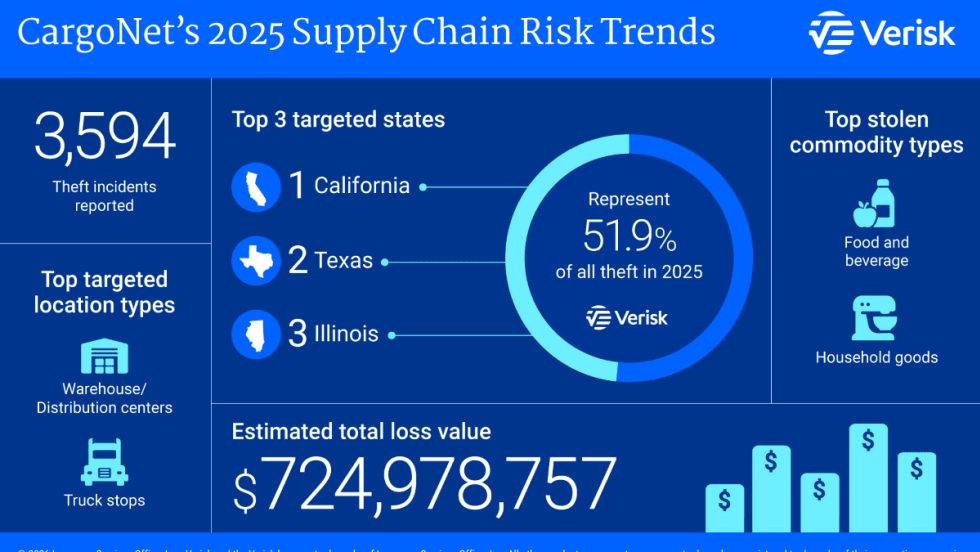

Cargo theft losses hit $725 million last year. In this HDT Talks Trucking Short Take video, Scott Cornell explains how a bill moving in Congress could bring federal tracking, enforcement, and prosecutions to help address the problem.

Read More →

Cargo theft activity across North America held relatively steady in 2025 — but the financial damage did not, as ever-more-sophisticated organized criminal groups shifted their cargo theft focus to higher-value shipments.

Read More →

A new partnership between Phillips Connect and McLeod allows fleets to view trailer health, location, and cargo status inside the same McLeod workflows used for planning, dispatch, and execution.

Read More →