Buoyed by a sustained strength of the U.S. economy, trailer sales showed significant increases in the first quarter of 2000, but it could be downhill from here, says Economic Planning Associates.

According to the latest manufacturer survey by the Smithtown, N.Y., research firm, first-quarter shipments totaled almost 81,000 units, up 7.2% from first quarter 1999 and 10% from fourth quarter. Van trailer shipments totaled 63,150 units, up 7.6% from last year. Non-van shipments came in at about 17,800 units, up 5.8%. Insulated, dry van, tank, low bed and dump trailers all showed substantial gains.

“Many customers markets in the U.S. are supporting continued high levels of transportation equipment demand,” noted EPA President Peter Toja. Construction activities are strong. Increased shipments of chemical and plastics products, along with higher exports of liquid foods and beverages, has led to a rebound in profitability of the chemicals, plastics and food industries, he said. Aggressive government response to reports of steel product “dumping” by foreign producers, coupled with rising construction activity and increased durable goods output, has stimulated domestic steel production and improved profits, he added.

But Toja cautioned that some negative factors will dampen trailer demand this year and into 2001. “Profits of the major carriers are under intense pressure this year,” he said, noting that first quarter profits for publicly held truckload and less-than-truckload carriers were about 10% above first quarter 1999 but profits were down 3.3%. Reasons include higher fuel costs, increased driver compensation, and e-commerce start-up costs.

Sales of new trailers will also likely be slowed by higher interest rates, which do not increase capital equipment costs but dampen consumer spending, which ultimately impacts the demand for freight services.

“Given the current financial constraints, the large amount of relatively new equipment in the system, and the memory of parked equipment earlier this year, we believe that the equipment purchase/lease decision will turn decidedly cautious this year and next,” Toja said. “From this point, we expect a gradual easing in quarterly trailer shipments through the end of this year and into the first half of 2001.”

Intermodal equipment will also feel the pinch. First quarter shipments of containers and container chassis were approximately 7,200 units, up 14% from first quarter 1999. According to Toja, U.S. container haulings in the first 15 weeks of this year were running 10.4% ahead of the same period last year. Canadian container movements were up 12.3%. The growth is attributed to strong economies in both countries plus expanding global trade.

“Given the acceleration in container haulings and the strong interest in 53-foot containers, we look for continued growth in container and chassis demand,” he said. “However, our industry sources are indicating a marked slowing in orders in recent months, implying a digestive phase is about to set in.” Container and chassis shipments are thus expected to slow some this year and the first part of 2001.

For more information, contact Economic Planning Associates at (631) 864-4900.

Trailer Sales May Have Peaked in First Quarter

Buoyed by a sustained strength of the U.S. economy, trailer sales showed significant increases in the first quarter of 2000, but it could be downhill from here, says Economic Planning Associates

More Fleet Management

Truckload Carriers Association Names Jim Mullen President

Mullen has trucking experience with government, associations, trucking companies and suppliers.

Read More →

Trucking the Super Bowl: How Super Bowl LX Impacted Freight Volumes

Super Bowl LX drove a spike in trucking freight volumes into San Jose. New data shows which equipment types benefited most.

Read More →

How Cybercrime Is Reshaping Cargo Theft and Fleet Risk in 2026

Artificial intelligence is changing how cybercriminals and cargo thieves target trucking fleets—and how fleets defend themselves. As phishing, impersonation, and cargo theft converge, cybersecurity is becoming a core part of fleet safety and operations.

Read More →

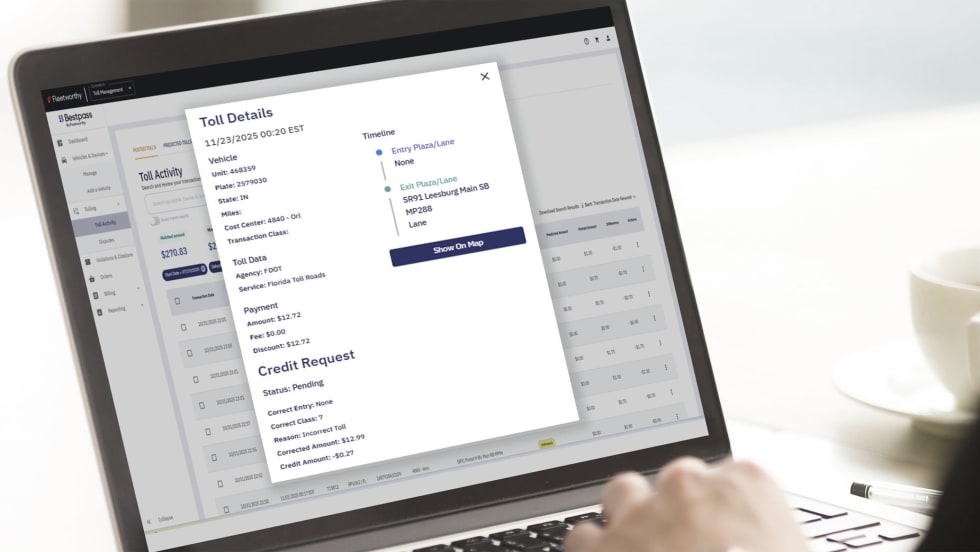

Fleetworthy's AI-powered Toll360 Gives Fleets Real-Time Toll Visibility and Automated Dispute Handling

Fleetworthy's new Bestpass Toll360 add-on uses route data and AI to predict toll charges, reconcile invoices, and automatically file eligible disputes—helping fleets cut manual work and recover overpayments.

Read More →

Mack Financial Services Launches Physical Damage Insurance For All Makes

Mack Financial Services has introduced the Rolling Asset Program, offering physical damage insurance for all makes and models within a customer's fleet.

Read More →

New Phishing Scheme Targets Motor Carriers, FMCSA Warns

Beware of a new phishing scheme targeting motor carriers. Scammers are sending emails posing as FMCSA or DOT officials to steal data.

Read More →

DTNA Partners with Class8 to Expand Digital Services for Freightliner Owner-Operators

A new partnership brings free wireless ELD service plus load optimization and dispatch planning tools to fourth- and fifth-generation Freightliner Cascadia customers, with broader model availability planned through 2026.

Read More →

Reducing Fleet Downtime with Advanced Diagnostics

This white paper examines how advanced commercial vehicle diagnostics can significantly reduce fleet downtime as heavy duty vehicles become more complex. It shows how Autel’s CV diagnostic tools enable in-house troubleshooting, preventive maintenance, and faster repairs, helping fleets cut emissions-related downtime, reduce dealer dependence, and improve overall vehicle uptime and operating costs.

Read More →

Stop Watching Footage, Start Driving Results

6 intelligent dashcam tactics to improve safety and boost ROI

Read More →

Werner Expands Dedicated Fleet Nearly 50% With FirstFleet Acquisition

The $283 million acquisition of FirstFleet makes Werner the fifth-largest dedicated carrier and pushes more than half of its revenue into contract freight.

Read More →