Interest rates have been cut by the Federal Reserve Bank for the 11th time this year in a move to put some life into a weak American economy.

Tuesday the Federal Open Market Committee cut the target for the federal funds rate (the interest banks charge each other on overnight loans) by .25% (25 basis points) to 1.75%, the lowest since July 1961. Also, The Board of Governors approved a .25% cut in the discount rate (the interest rate the Fed charges to make direct loans to banks) to 1.25%.

In a written statement, Fed officials said, “Economic activity remains soft, with underlying inflation likely to edge lower from relatively modest levels. To be sure, weakness in demand shows signs of abating, but those signs are preliminary and tentative," noteing that currently, "risks are weighted mainly toward conditions that may generate economic weakness in the foreseeable future."

Newport Communications Senior Economist Jim Haughey says today's action by the Fed is a "feel-good" move. "It will not have any significant immediate impact on borrowing rates, investment or other spending beyond some additional mortgage refinancing," he says. "The economic problem remains surplus capacity and inventory and the demand weakness is now more abroad than here in the U.S."

Haughey says we have become accustomed to looking to the fed to deal with demand and inflation problems, and the fed has responded with the only thing it can do. "Hopefully, buyers will be a little more confident knowing that the fed is on the job."

Haughey notes it is not too soon to start worrying about what happens when the fed begins to reverse the process and boosts interest rates from from under 2% up to the more normal 5-6%, consistent with the 2% inflation and 3-4% GDP growth rates widely expected for six to nine months ahead.

The decision by the Fed comes after a survey of manufacturing executives was released this morning indicating some better times are seen for the U.S. economy and for the manufacturing sector, which is a major trucking customer.

The National Association of Purchasing Management reported 59% of executives responsible for buying raw materials for manufacturers see higher revenues in 2002, compared to 2001; however, their spending is expected to decrease.

The 62nd semiannual survey also found that manufacturers were “less than bullish” for business prospects for the first half of next year and they expect employment to drop another half a percent within the next year.

They’re predicting revenues for this year will fall an average of 2.3 percent from 2000, but they see them growing 3.2% next year.

In the past year, manufacturing activity in the U.S. has plummeted, resulting in massive layoffs and less freight for the trucking industry.

Also on Tuesday, the U.S. Commerce Department released figures showing wholesale inventories fell 1% in October, the biggest drop since the data has been tracked since 1992.

This marks the fifth straight monthly decline and normally could lead to some businesses having to order more products, most of which are shipped by truck. However, sales on the wholesale level also fell during October and may negate any expected gain. They fell 1.4%, following a drop of 1.2% in September.

Interest Rates Cut, Manufacturers See Better Times While Wholesale Inventories, Sales Fall

Interest rates have been cut by the Federal Reserve Bank for the 11th time this year in a move to put some life into a weak American economy

More Fleet Management

Truckload Carriers Association Names Jim Mullen President

Mullen has trucking experience with government, associations, trucking companies and suppliers.

Read More →

Trucking the Super Bowl: How Super Bowl LX Impacted Freight Volumes

Super Bowl LX drove a spike in trucking freight volumes into San Jose. New data shows which equipment types benefited most.

Read More →

How Cybercrime Is Reshaping Cargo Theft and Fleet Risk in 2026

Artificial intelligence is changing how cybercriminals and cargo thieves target trucking fleets—and how fleets defend themselves. As phishing, impersonation, and cargo theft converge, cybersecurity is becoming a core part of fleet safety and operations.

Read More →

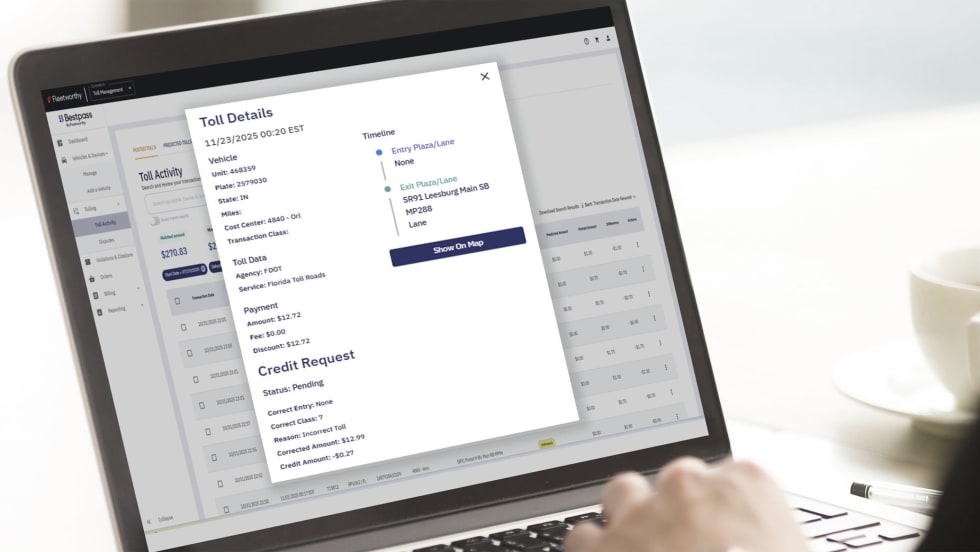

Fleetworthy's AI-powered Toll360 Gives Fleets Real-Time Toll Visibility and Automated Dispute Handling

Fleetworthy's new Bestpass Toll360 add-on uses route data and AI to predict toll charges, reconcile invoices, and automatically file eligible disputes—helping fleets cut manual work and recover overpayments.

Read More →

Mack Financial Services Launches Physical Damage Insurance For All Makes

Mack Financial Services has introduced the Rolling Asset Program, offering physical damage insurance for all makes and models within a customer's fleet.

Read More →

New Phishing Scheme Targets Motor Carriers, FMCSA Warns

Beware of a new phishing scheme targeting motor carriers. Scammers are sending emails posing as FMCSA or DOT officials to steal data.

Read More →

DTNA Partners with Class8 to Expand Digital Services for Freightliner Owner-Operators

A new partnership brings free wireless ELD service plus load optimization and dispatch planning tools to fourth- and fifth-generation Freightliner Cascadia customers, with broader model availability planned through 2026.

Read More →

Reducing Fleet Downtime with Advanced Diagnostics

This white paper examines how advanced commercial vehicle diagnostics can significantly reduce fleet downtime as heavy duty vehicles become more complex. It shows how Autel’s CV diagnostic tools enable in-house troubleshooting, preventive maintenance, and faster repairs, helping fleets cut emissions-related downtime, reduce dealer dependence, and improve overall vehicle uptime and operating costs.

Read More →

Stop Watching Footage, Start Driving Results

6 intelligent dashcam tactics to improve safety and boost ROI

Read More →

Werner Expands Dedicated Fleet Nearly 50% With FirstFleet Acquisition

The $283 million acquisition of FirstFleet makes Werner the fifth-largest dedicated carrier and pushes more than half of its revenue into contract freight.

Read More →