From the September 2016 issue of Heavy Duty Trucking

Retail sales are important – not just to the overall economy, but also to trucking – and the game is changing big-time, possibly thanks to an entire generation.

Retail sales are important – not just to the overall economy, but also to trucking – and the game is changing big-time, possibly thanks to an entire generation.

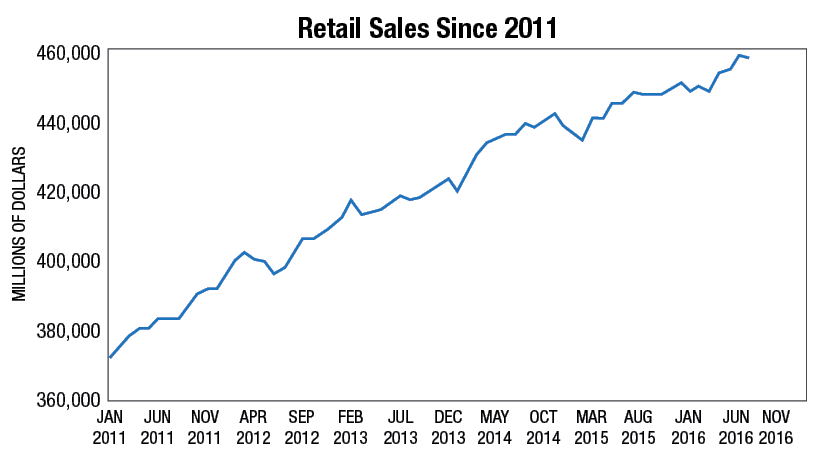

Source: U.S. Census Bureau, Advance Monthly Sales for Retail and Food Services, Seasonally Adjusted

From the September 2016 issue of Heavy Duty Trucking

Retail sales are important – not just to the overall economy, but also to trucking – and the game is changing big-time, possibly thanks to an entire generation.

About two-thirds of U.S. economy is driven by retail sales. Compare that to around 12% for manufacturing. As for why it’s important to trucking, surely you’ve heard the line, “If you bought it, a truck brought it.”

The good news is retail sales, including food service sales, were up 2.8% in July from a year earlier. The bad news is that when you compare July to the month before, sales were flat, following a second quarter in which sales increased at a 4.2% annual rate.

This could just be a blip, but others note this may be the beginning of a whole paradigm shift in American spending habits.

Online sales are booming, meaning the traditional patterns of distributing and selling goods isn’t the only game in town. In the second quarter, e-commerce sales totaled $97.3 billion, up 4.5% from the first quarter. And e-commerce sales were up 15.8% while total retail sales moved up just 2.3%. E-commerce as a percent of total sales was 7.5% in the second quarter versus 6.6% a year earlier.

In other words, people are still spending. They just aren’t doing it the same way they used to – and that has some retailers scared.

In August, department store giant Macy’s said it would close around about 100 stores, cutting its footprint by around 15%, to strengthen its presence as an “omnichannel shopping destination.” The move was greeted with a thumbs-up by many analysts. Retailing behemoth Walmart recently bought online retailer Jet.com for $3.3 billion to increase its e-commerce presence and broaden its audience.

There’s another way spending is changing. According to the Wall Street Journal, since 2000 consumers are spending less on goods and more on services. Part of it’s by necessity, with more going for non-discretionary items such as healthcare, housing, student debt and transportation. But consumers also spending more on travel and leisure activities, which are estimated to have increased in July 8.6% from a year earlier, and less on buying the “stuff” that goes in your trucks.

If pressed to name a single factor driving these different trends, I’d have to say millennials. This generation that reached adulthood around the turn of the century is doing things differently…a whole lot differently than my not-long-after-baby boomer generation did.

Trucking companies have already seen difficulties in recruiting millennials as drivers, as this generation make it clear they want their lives to be different than those of their parents. They generally prefer to live smaller and lighter, eschewing many big-ticket items their parent purchased – and they don’t want their hand-me-downs. More than three in four millennials (78%) would choose to spend money on an experience or event over buying something desirable, according to a frequently cited Harris survey of more than 2,000 U.S. consumers.

With these differences between millennials and baby boomers, it should come as no surprise they will transform one of the biggest parts of the American economy. Even if individually millennials don’t buy as much of some types of products, collectively it’s a big group. Investment firm Goldman Sachs describes millennials as “one of the largest generations in history [and] is about to move into its prime spending years.”

The result will be a big shift in not just how retail goods are sold, but how they are delivered by trucks.

Mack Financial Services has introduced the Rolling Asset Program, offering physical damage insurance for all makes and models within a customer's fleet.

Read More →

Beware of a new phishing scheme targeting motor carriers. Scammers are sending emails posing as FMCSA or DOT officials to steal data.

Read More →

A new partnership brings free wireless ELD service plus load optimization and dispatch planning tools to fourth- and fifth-generation Freightliner Cascadia customers, with broader model availability planned through 2026.

Read More →

This white paper examines how advanced commercial vehicle diagnostics can significantly reduce fleet downtime as heavy duty vehicles become more complex. It shows how Autel’s CV diagnostic tools enable in-house troubleshooting, preventive maintenance, and faster repairs, helping fleets cut emissions-related downtime, reduce dealer dependence, and improve overall vehicle uptime and operating costs.

Read More →

6 intelligent dashcam tactics to improve safety and boost ROI

Read More →

The $283 million acquisition of FirstFleet makes Werner the fifth-largest dedicated carrier and pushes more than half of its revenue into contract freight.

Read More →

B2X Rewards is a new, gamified rewards program aimed at driving deeper engagement across BBM’s digital platforms, newsletters, events, and TheFleetSource.com.

Read More →

Trucking’s biggest technology shifts in 2026 have one thing in common: artificial intelligence.

Read More →

Why discipline, relationships, and focus have mattered more than size for smaller trucking fleets during the freight recession.

Read More →

Cargo theft losses hit $725 million last year. In this HDT Talks Trucking Short Take video, Scott Cornell explains how a bill moving in Congress could bring federal tracking, enforcement, and prosecutions to help address the problem.

Read More →