“A lot of [merger and acquisition] deals got done in 2022, but it was day and night going from the first to the second half of the year,” said Spencer Tenney, CEO of the Tenney Group, during a Jan. 26 Truckload Carriers Association webinar on M&A trends in trucking and logistics. Franklin, Tennessee-based Tenney Group is an M&A firm serving the transportation and logistics industry.

M&A Trucking and Logistics Activity to Stay Strong in 2023

Despite the drop-off in the second half of 2022, the fundamental factors that have been driving trucking mergers and acquisitions are still alive and well.

2022 was a busy year for mergers and acquisitions in trucking and logistics.

Graphic: HDT/Canva

Tenney explained that in the first half, M&A activity galloped along thanks to a “Wild, Wild West” environment fueled by such key positives as:

“’Free debt’ in terms of extremely low interest rates.”

The general drive to expand supply chain capabilities

“Once-in-a-lifetime increases in used equipment values.”

Together, that “created all kinds of opportunities for both buyers and sellers to get deals done,” he said.

But the tide turned in the second half. For starters, driver pay spiked upward and insurance costs rose 7.4% over 2021. And equipment values fell sharply. By December, Tenney saw 21% reduced value compared to the year-earlier period.

What’s more was the beatdown taken from the Fed’s seven interest rate hikes by year’s end.

Those hikes certainly got the attention of the debt and capital markets, especially in Q4. Many deals we were working on went on pause.” Tenney explained that, “When you increase the cost of capital that much in one period [Q4 2022], it affects the way people assess risks and how they engage in the M&A market.”

Urge to Merge

Yet the urge to merge remained strong. “What’s fascinating is that still a lot of deals got done, even considering 40-year record high inflation as well,” Tenney said.

In discussing some of the firm’s notable deals in 2022, Davis Looney, Tenney Group’s director of Business Development, pointed out a trend toward foreign investment. For example, Austria-based Berger Logistik acquired Super-T Transport, and Germany-based DB Schenker acquired USA Truck. “These were foreign investors making their first transportation investments in North America,” Looney said.

During the webinar, Tenney and Looney referenced the firm’s recently released annual M&A report on the transportation and logistics space. The report is geared toward those interested in buying or selling companies in the annual revenue range of $20 million to $300 million.

In their remarks and spelled out in more detail in the report, the two executives discussed Tenney Group’s predictions of the state of play in M&A in 2023:

Valuations normalize and structures evolve

In 2023, Tenney Group believes we will likely see a normalizing in valuations. This will be especially true for asset-light businesses. According to Price Waterhouse Cooper, asset-light businesses have experienced seven straight years of increased values.

“Still, the fundamental factors that have been driving high M&A activity are still alive and well. We expect valuations to stay competitive and for deal structures to address new and evolving risks in the market… to maximize outcomes, buyers and sellers will have to consider these factors to maximize desired outcomes.”

Strategic shift in acquisition target profiles

“Freight volatility influences the way buyers evaluate transaction risks. We are noticing several experienced industry acquirers modifying their target acquisition profiles for 2023… We expect experienced acquirers to use these next 12 months to diversify their revenue types and to enhance their capabilities through proven winners.”

Tenney also expects to see regional players “reduce the floor size of their typical acquisition profile. “‘Tuck-in acquisitions’ [when a large entity completely absorbs a smaller one] will be pursued to offset growth limitations linked to driver recruitment/retention and to offset the relentless rise of expenses.

“Due to a dramatic increase in first-time acquirers combined with the rising cost of capital, companies available to purchase [operating] with 100 or less trucks will attract much more attention than they have in previous years.”

Higher deal activity but smaller transactions in Q3 ’22

“Tenney Group accepted more new buyer registration profiles in the third quarter of last year than in any other quarter in company history. “This was during a 40-year inflation peak and after multiple interest rate hikes,” they said. “We contend that the reason for this was that many acquirers that wanted and needed to buy in 2021/2022 believed that market value was overinflated. Consequently, many qualified buyers stayed on the sidelines.”

But that is changing quickly. And many potential sellers delayed exiting because of record profits. There were also sellers who attempted to exit but overplayed their non-reoccurring financial performance.

“Now that performance is normalizing to some degree, we believe the environment will be ideal for buyers and sellers to have a meeting of the minds on value and structure.” Also, aging baby boomer owners with no successor and averse to taking on more risk present a “considerable supply” of companies to purchase… “All other factors point to a very active year of M&A. Challenge headlines that say otherwise.”

More Fleet Management

Run on Less “Messy Middle” Data Shows Multiple Paths Forward for Truck Powertrains [Watch]

NACFE's Run on Less - Messy Middle project demonstrates the power of data in helping to guide the future of alternative fuels and powertrains for heavy-duty trucks.

Read More →

Federal Court Lets NYC Congestion Pricing Continue

A federal court ruling allows New York City’s congestion pricing program to continue, leaving truck tolls in place for fleets delivering into Manhattan.

Read More →

Federal Court Lets NYC Congestion Pricing Continue

A federal court ruling allows New York City’s congestion pricing program to continue, leaving truck tolls in place for fleets delivering into Manhattan.

Read More →

Fontaine Modification Launches Real-Time Truck Modification Tracking Portal

Fontaine Modification has introduced a new customer portal designed to give fleets real-time visibility into the truck modification process, addressing one of the most common questions fleet managers face: “Where’s my truck?”

Read More →

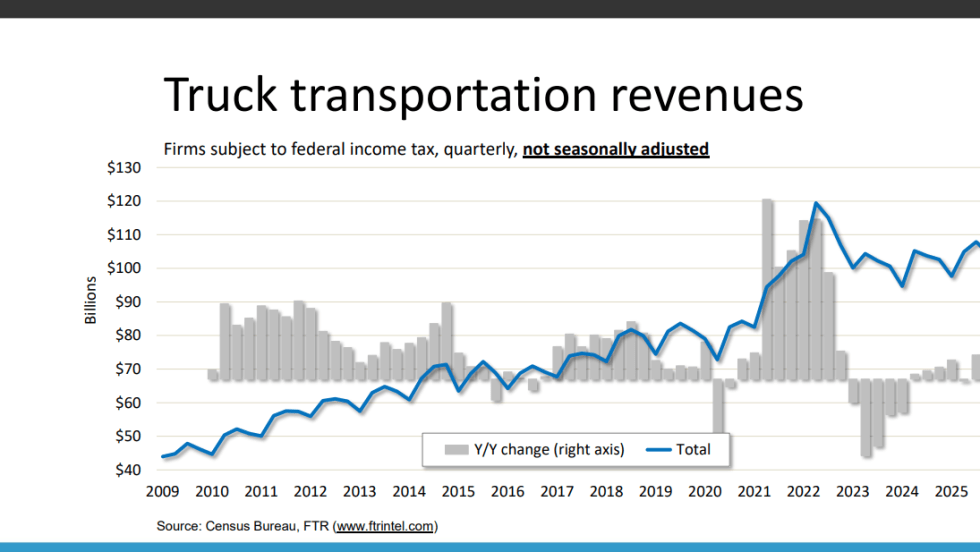

FTR: Trucking Conditions Index Climbs to Highest Level Since 2022

Strong freight rates, rising volumes and tighter capacity push trucking conditions higher, though diesel prices could temper gains in the near term, FTR cautions.

Read More →

Smarter Maintenance Strategies to Keep Trucks Rolling

In today’s cost-conscious market, fleets are finding new ways to get more value from every truck on the road. See how smarter maintenance strategies can boost uptime, control costs and drive stronger long-term returns.

Read More →

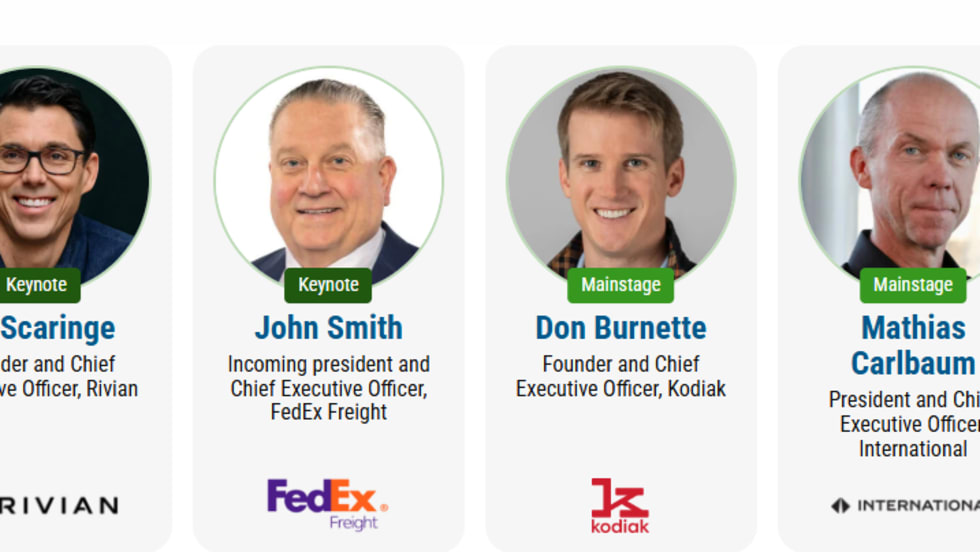

ACT Expo 2026 Unveils Speaker Lineup Focused on Real-World Fleet Technology Deployment

Nearly 400 executives and fleet leaders will address AI, autonomy, zero-emission vehicles, and connected technologies at ACT Expo 2026 event in Las Vegas in May.

Read More →

How Thermo King’s AI-Fueled Telematics Drive Fleet Efficiency

Thermo King's AI-powered telematics enhance fleet efficiency with smart monitoring, predictive maintenance, and real-time insights. Improve uptime and help reduce costs with these advanced digital solutions.

Read More →

NMFTA Targets Freight Fraud and Telematics Supply Chain Risks

New carrier identity checks, industry resources, and telematics supply chain research aim to make freight fraud and cyber risks harder to exploit.

Read More →

Bobit Business Media Expands Fleet Technology Platform with Acquisition of Roadz Partner Portfolio

Bobit Business Media has acquired key partner agreement assets from Roadz, expanding its role as a go-to-market partner for fleet technology providers and strengthening its digital sourcing capabilities.

Read More →