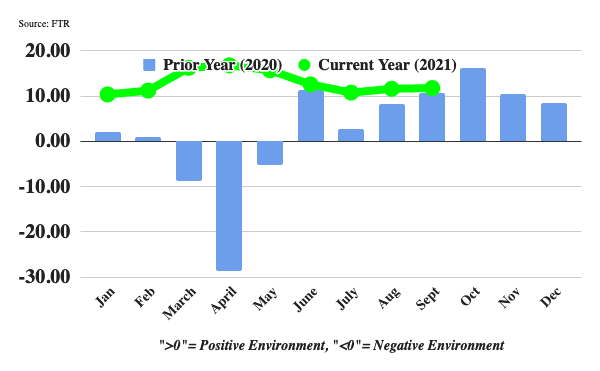

Freight rates continued to strengthen in September, but freight volume and capacity utilization were not as beneficial to carriers as they were in July and August, according to FTR’s Trucking Conditions Index.

The September TCI increased marginally to 11.79 from 11.63 in August. FTR’s forecast remains for strong positive TCI readings well into 2022.

“The market remains stubbornly favorable to carriers, due in large part to continued strong consumer spending and the effects of supply chain troubles on productivity,” said Avery Vise, FTR’s vice president of trucking. “The latest payroll employment data for trucking implies a considerably stronger recovery in driver capacity than had appeared previously, but the ongoing surge in newly authorized small carriers continues to shift capacity and thwart a return to normal."

About those employment numbers: Vise told HDT that total trucking employment in September was 1.1% below February 2020, but production/nonsupervisory employee jobs were down 2.3%. This implies that drivers are a drag on trucking’s recovery, not a contributor to it. With one exception, all segments of trucking in the BLS data are down. The one major exception is local general freight trucking, which has seen a 5.2% increase in total payroll employees and a 7% increase in production/nonsupervisory employees. On the other hand, long-haul general freight truckload is down 2.9% in total jobs and 5.3% among production/nonsupervisory employees.

So while those payroll employment numbers look good on the surface, a deeper dive indicates what the trucking industry already knows, that long-haul trucking is having a hard time finding drivers.

“Even if carriers start to see recruiting challenges ease up, continued struggles in truck production due to parts and material shortages could limit capacity in the months ahead," Vise said. "A key factor for the freight market will be whether consumer spending remains so robust beyond the holidays and the end of advance child tax credit payments in December.”

The TCI tracks the changes representing five major conditions in the U.S. truck market: freight volumes, freight rates, fleet capacity, fuel price, and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.