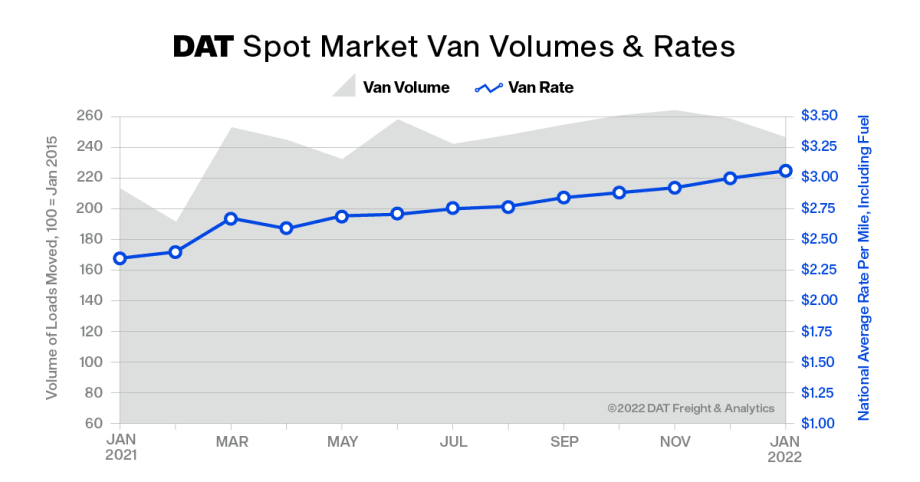

Spot truckload freight hit new highs in January, nearly $1 a mile higher than a year ago, according to DAT Freight & Analytics, even as the number of loads moved dropped throughout the month.

Spot market rates for dry van and refrigerated freight rose for the eighth straight month, nearly $1 higher than the national average a year ago, according to DAT, which reports data based on its large truckload freight marketplace and DAT iQ data analytics service.

Spot truckload rates are negotiated on a per-load basis and paid to the carrier by a freight broker. DAT’s rate analysis is based on $116 billion in annualized freight transactions.

The van rate averaged $3.11 per mile in January, an 11-cent increase over December. The average reefer rate was $3.59 per mile, up 12 cents month over month.

Dry Van: At $3.11 per mile, the national average spot rate for van freight increased 11 cents compared to December and was 99 cents higher year over year.

Refrigerated: The national average rate for reefer loads on the spot market increased 12 cents to $3.59 per mile, up 98 cents compared to January 2021.

Flatbed: The average spot flatbed rate rose 6 cents to $3.14 a mile in January. The spot flatbed rate has been above $3 a mile for nine consecutive months and is 64 cents higher year over year.

However, spot rates include fuel surcharges. DAT reported that the national average diesel fuel surcharge was 41 cents a mile for van freight in January, a seven-year high.

As of the end of January, the price of a gallon of ultra-low-sulfur diesel was more than a dollar higher than a year ago, according to retail price data tracked by the Department of Energy. They reached a $3.85 national average, compared to $2.72 a year earlier.

Truckstop.com, which also tracks spot rates posted in its load-matching system, reported that in the week ended Feb. 4, spot rates in the Truckstop.com system increased about 5 cents per mile — the first increase since the final week of 2021. Rates had fallen nearly 23 cents from the near-record level at the end of the year.

Rates were up in each of the three principal segments — dry van, refrigerated, and flatbed — although rising diesel prices accounted for a significant share of the gains week over week. Load postings declined 5.9%, primarily due to flatbed.

Total rates were nearly 23% higher than the same week last year. Excluding fuel, rates were about 16% higher, according to Truckstop.com.

Truckload Volumes

DAT’s Truckload Volume Index was 229 last month. Although it was a 3.8% decline compared to December, it’s the highest DAT has ever recorded for January and a 15% increase over the same time a year ago. The number of loads posted to the DAT One load board network increased 37.4% compared to December and 104.7% versus January 2021.

“Load-to-truck ratios on the DAT load board network hit record highs for January, a sign of exceptionally strong demand for truckload services,” said Ken Adamo, DAT chief of analytics. “While the number of loads moved gradually eased throughout the month, tight capacity and disruptions due to winter weather and COVID-19 helped push rates to historic levels.”

Record Load-to-Truck Ratios

DAT’s national average van load-to-truck ratio was 9.3, up from 6.5 in December, meaning there were 9.3 available loads for every available van on the DAT network.

The van load-to-truck ratio has increased from December to January only once before, from December 2017 (5.1) to January 2018 (6.0).

The reefer load-to-truck ratio was 20.4, up from 14.0 in December and 8.2 in January 2021.

The flatbed ratio spiked to 86.7 from 51.1 in December, a 69.6% increase. It was 47.9 in January 2021.

In contract rates, DAT reported that the national average shipper-to-broker contract van rate was $2.98 per mile in January, up 4 cents month over month. The average contract reefer rate edged 3 cents higher to $3.16 a mile and the average contract rate for flatbed freight was down 1 cent to $3.33 a mile.