A reduction in truck capacity was a concern for the trucking industry when the electronic logging device mandate soft enforcement period ended April 1, yet capacity has increased 11% on the spot market since then, according to DAT Solutions.

But it doesn’t mean that ELDs aren't having an impact on the industry. DAT recently surveyed its carrier customers about ELDs and detention, the majority of which were owner-operators, and found the ELDs were negatively affecting profitability.

Owner-operators are the hardest hit by the ELD regulation, having to personally take on the cost of buying and installing a solution as well as dealing with potential reduced productivity, according to DAT.

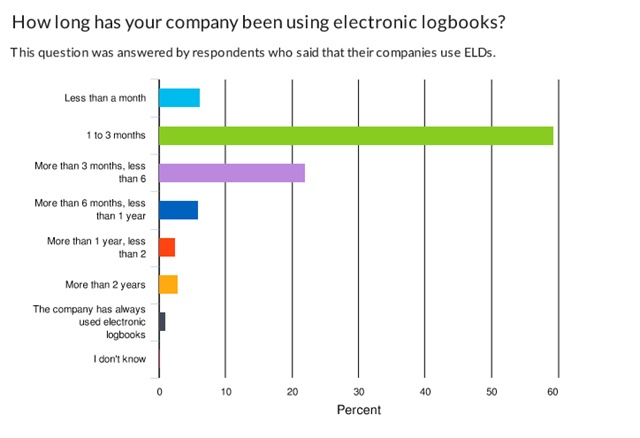

Most survey respondents were currently running ELDs; nearly 60% of those carriers had implemented electronic logs in the past three months. Of the carriers running ELDs, more than 70% reported that they were earning less money than they were prior to implementation.

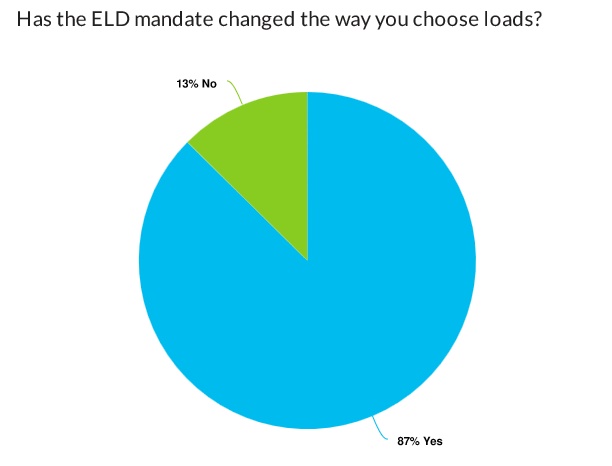

A majority were also driving fewer miles now than before installing ELDs, and 71% said they were making less money. DAT asked respondents if the ELD mandate had changed how they prioritize loads, and 87% said yes.

The inflexibility of hours of service rules while using ELDs has caused detention time to hit drivers harder since implementation. Carriers said that rate per mile was the most important factor in deciding to take a load, followed by the length of haul and a broker’s reputation. The least important factor was traffic on the route.

According to DAT, shippers are not taking driver hours of service into account during loading and offloading, with more than 77% reporting wait times of more than two hours on one out of every five loads. And to top it off, when drivers need to stop driving, as many as 87% of them are having a much harder time finding parking since the ELD mandate took effect in December.

Despite the growing pains of ELD implementation and some previous fears of a mass exodus of owner-operators from the trucking industry once the mandate kicked in, only 2.8% of those surveyed said they were likely to leave the trucking industry.

The DAT ELD and Detention report is available here.

Originally posted on Automotive Fleet

0 Comments

See all comments