Newly released figures on the health of the North American freight marketplace as well as on U.S. truckload linehaul and intermodal rates show all are at or near record highs.

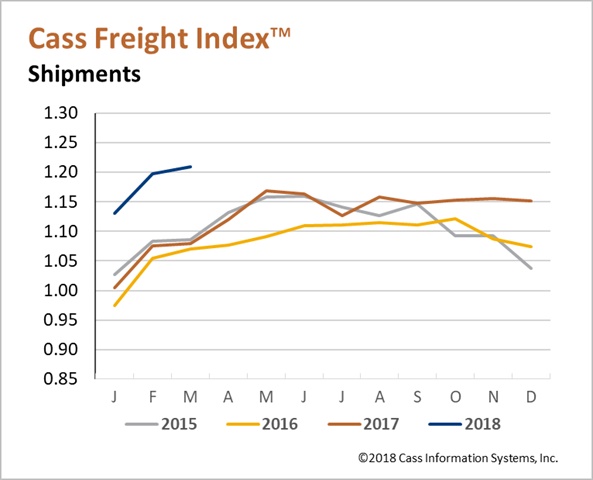

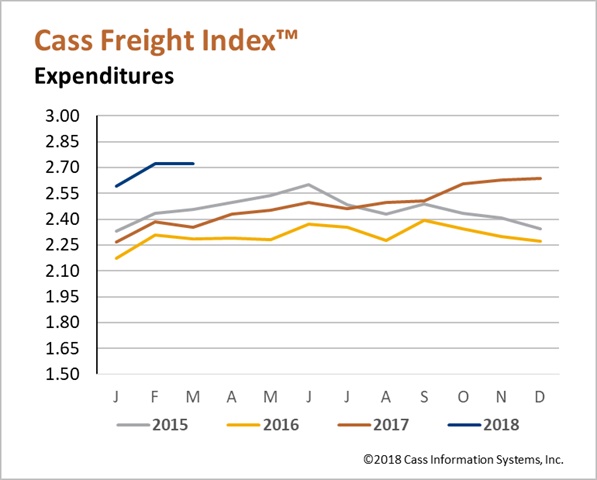

Both the shipments and expenditures indexes in the Cass Freight Index extended their run into positive territory during March, and are displaying accelerating strength.

The shipments index registered 1.209, up just 0.9% from February, but it also posted a whopping 11.9% improvement from March 2017.

The expenditures index increased even more to a level of 2.723, a 15.6% jump in March from the same time a year ago while being unchanged from the month before.

The reason, according to Donald Broughton, founder and managing partner of Broughton Capital, an economic and equity research firm, who provides analysis of the report, is that “freight volume has continued to grow at such a pace that capacity in most modes has become extraordinarily tight.”

Broughton also said, “In turn, pricing power has erupted in those modes to levels that spark overall inflationary concerns in the broader economy, however fear of long-term inflationary pressure is moderate given technology provides multiple ways to increase asset utilization and price discovery in all parts of the economy, especially in transportation.”

According to him, this growth in both freight shipments and expenditures is a sign the U.S. economy is not only growing, but rather the intensity of the growth is stronger.

Data within the index includes all domestic freight modes and is derived from $25 billion in freight transactions processed by Cass annually on behalf of its client base of hundreds of large shippers.

You can read the full report here.

Meantime, two other gauges have also posted impressive numbers for March.

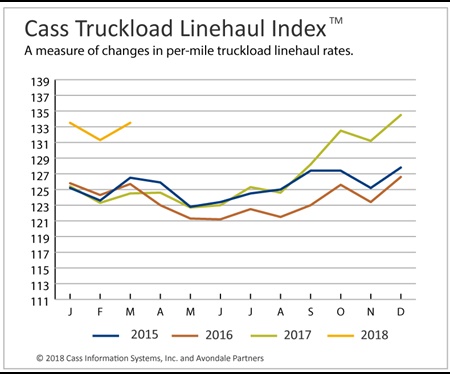

The March Cass Truckload Linehaul Index continued the acceleration established over the last four months by posting a 7.2% year-over-year increase, the largest year-over-year percentage increase since January 2015, as it hit a level 133.5. This ties the earlier record from just two months earlier.

After being negative for 13 months in a row - from March 2016 through March 2017 - the measure has not only been positive now for twelve months in a row, but pricing for trucking continues to gain momentum, according to Broughton.

The Cass Truckload Linehaul Index measures market fluctuations in per-mile truckload pricing that isolates the linehaul component of full truckload costs from others, such as fuel and accessorials, providing a reflection of trends in baseline truckload prices.

On the intermodal side, the latest data point showed total intermodal pricing rose 5.8% year-over-year in March, according to the Cass Intermodal Price Index, with it hitting a new all-time high reading of 143.2.

March marked the 18th consecutive month of increases and brings the three-month moving average up to 5.4%.

Tight truckload capacity and higher diesel prices are creating incremental demand and pricing power for domestic intermodal, according to Broughton.

The Cass Intermodal Price Index measures market fluctuations in per-mile U.S. domestic intermodal costs. It includes all costs associated with the move, such as linehaul, fuel and accessorials.

Data within both the truckload and intermodal gauges come from actual freight invoices paid on behalf of clients of freight-payment processor Cass Information Services.

0 Comments

See all comments